In a recent ULI webinar, a panel of experts discussed the dynamics of the Asia Pacific’s fast-growing market for environmental, social, and governance (ESG) related debt. While the growth of the green finance market regionally still lags that in Europe, the pace of adoption is picking up rapidly.

Green lending can be tied to a variety of issues ranging from housing affordability to diversity and inclusion in corporate boardrooms. The biggest investment theme by far, however, relates to the environment, and in particular projects that address climate change.

(Citibank)

One key factor, according to James Arnold, head of the Global Subsidiaries Group at Citibank, is that more than 30 percent of banks globally have adopted the U.N. Principles for Responsible Banking. These require banks to impose an ESG lens on their lending decisions.

In addition, more investment funds are embracing standards such as the U.N. Principles for Responsible Investment [UNPRI], another set of guidelines for ESG-compliant investment. The principles set out a variety of best practices, including screening out potential investment portfolios with the worst ESG profiles, creating ESG scorecards for portfolio construction, and the use of activist strategies to challenge the management of companies in which investors hold shares.

On the regulatory side, some jurisdictions are trying to encourage the uptake of sustainable finance by increasing the transparency of local deal flow and opportunities. The Hong Kong stock exchange’s STAGE platform, for example, offers a voluntary repository of sustainable financial products that specify the number and types of green bonds issued by listed companies, together with details of structures and performance.

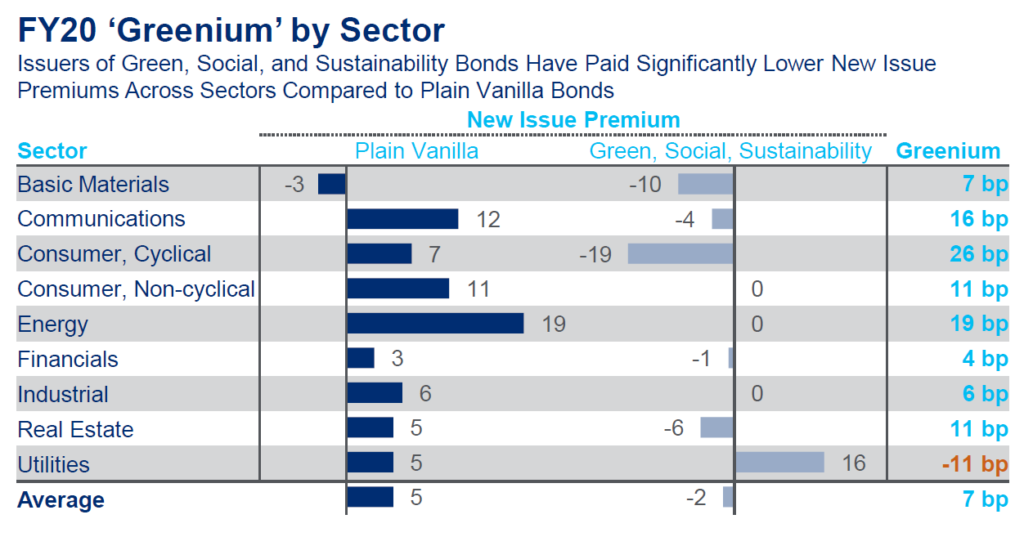

For borrowers, the main incentive is obvious—green finance is generally cheaper than conventional borrowing (i.e., it has a “greenium”). According to Arnold, “[Greeniums] vary by industry and tenor, but there is empirical evidence that companies accessing the bond or debt markets using a sustainable instrument can reduce cost of capital by using green or sustainable formats.”

Traditionally, green financing has adopted a “use of proceeds” structure, meaning that it is earmarked for use in a particular project such as renewable energy or affordable housing. In practice, however, a lack of flexibility in the use-of-proceeds approach has led to the emergence of “Sustainability KPI-linked” bonds and loans. These typically involve a company setting a series of ESG-related KPIs linked to their business that are measured annually.

Funds raised on this basis can be applied for general corporate purposes, with the coupon payable adjusted upward or downward each year depending on KPI performance. As a result, according to Ellie Tang, head of sustainability at Hong Kong developer New World Development [NWD]: “We’ve been able to standardize more of our ESG integration practices across business units, meaning we no longer have to look at certified green buildings or other sustainable initiatives as standalone practices, they’re just part of our day-to-day DNA. This gives us an entry point to look at more opportunities from sustainability-linked loans.”

NWD issued the world’s first U.S. dollar–denominated real estate developer sustainability-linked bond early in 2021. The issue was six times oversubscribed, with 80 percent of investors being funds or global insurers with an ESG mandate, according to Tang.

The growing momentum behind green finance has been reinforced by a significant number of institutional investors in Europe that have adopted ambitious ESG goals. This is partly because their clients are demanding lower carbon intensity and partly because of the impact of green finance on portfolio risk/return dynamics.

According to Jonathan Waite, Asia Pacific responsible investment and commerce manager at APG Asset Management: “We have a target to reduce carbon emissions of our portfolio by 40 percent by 2024 [from 2016 levels]. From a real estate perspective, we’ve therefore doubled the number of green building certifications that we have, and we’re looking to invest more in the green economy generally.”

One area where Europe continues to lead other parts of the world is the impact of new legislation requiring compliance with rules that will deliver a future of net-zero carbon emissions. According to Waite: “Every week there’s new legislation we need to comply with, and also a huge push, through frameworks like the E.U. taxonomy, to define what is sustainable and what can be sustainable.”

In particular, these new rules aim to counter “greenwashing,” a practice in which borrowers dress up projects to appear environmentally friendly in order to obtain favorable financing terms.

While the commitment to addressing climate change in the Asia Pacific region is still in its infancy, the writing is now on the wall, given especially how exposed many European cities are to its impact. As Citibank’s Arnold observes: “My view is that over time we will gravitate to a situation where just about all financing will have some ESG overhang—it will become the norm because of the way regulators are starting to demand disclosure and transparency.”

Ultimately, the need to comply with net-zero-carbon standards will drive both asset managers and developers to work out how to achieve that and what standard they align with. According to Arnold: “I see it getting really technical around this issue, but the question about net zero [carbon] is not there anymore—it’s just how and when.”