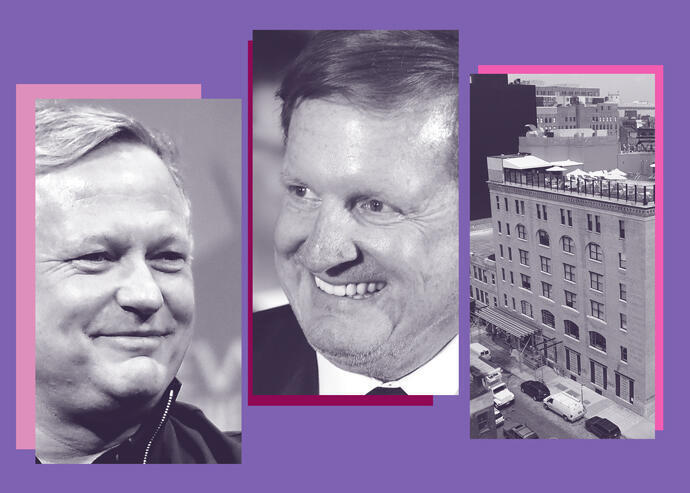

Soho House founders Nick Jones and Ron Burkle (Getty)

The owner of a network of members’ clubs built on exclusivity is offering up its stock to the masses.

Membership Collective Group, parent company of the Soho House chain of private clubs, raised $420 million in an initial public offering of 30 million shares Wednesday.

The shares sold at $14 each, the low end of an expected $14 to $16 range, according to Bloomberg. The IPO values the company at around $2.8 billion.

Based in London, MCG owns 30 Soho House clubs worldwide — including three in New York City —and has over 100,000 members, with tens of thousands of others on waiting lists. Ron Burckle’s Yucaipa Companies owns a majority stake in the company, which it retained after the IPO.

Soho House had considered an IPO as early as 2018. Things got more serious in February, when the company hired JPMorgan Chase and Morgan Stanley to advise on an IPO. It filed confidentially for the IPO in April.

The company lost $93 million in the roughly 13 weeks leading up to its IPO filing, more than twice what it lost in the same period in 2020. As of that time, the company had $826 million in debt that it planned to pay down with proceeds from the stock offering.

British hospitality executive Nick Jones founded the first Soho House in London in 1995. Despite its popularity and steadily growing footprint, it has yet to turn a profit.

Along with the Soho House clubs, Membership Collective Group owns nine workspaces in London, Los Angeles and New York, as well as the retailer Soho Home, according to Bloomberg.

The company furloughed nearly 90 percent of its staff in the early months of the pandemic, although it lost just 10 percent of its members thanks in part to in-house credit offers. [Bloomberg] — Dennis Lynch https://www.bloomberg.com/news/articles/2021-07-15/soho-house-owner-raises-420-million-in-members-only-club-s-ipo?sref=u4bIpjiR