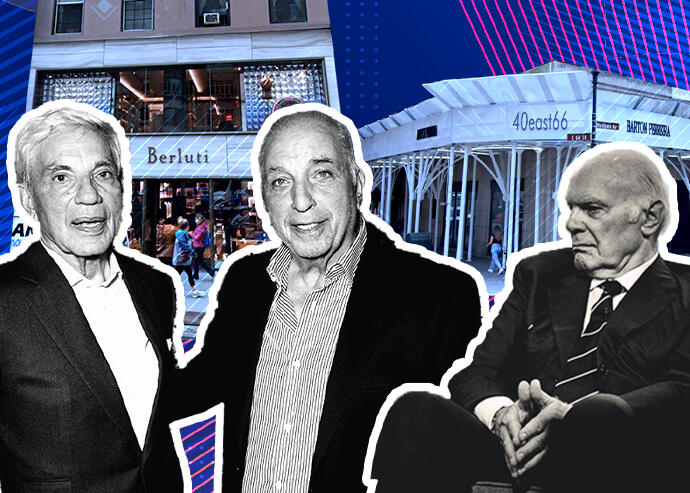

Reuben Brothers, Steve Roth, 677 Madison Avenue, and the ground floor retail portion of 40 East 66th Street (Google Maps, Getty)

The Reuben brothers extended their Madison Avenue buying spree last week, scooping up two properties with 130 feet of frontage along the beleaguered shopping corridor for a total of $50 million.

No financing documents were recorded with the purchases, suggesting all-cash deals. One of the properties was among five that seller Vornado Realty Trust recently said had been losing money due to a meager 30 percent occupancy rate. Dependent on foot traffic from emptied Midtown offices, retail has struggled to regain its foothold in the area.

While Manhattan may have fewer footfalls, it had more than its share of deals last week, capturing six of ten properties sold in the middle of the investment sales market, spanning $10 million to $30 million. Other sales involved a gun manufacturer, two historic Stone Street buildings and a 1,600-car parking facility at the 1.8 million-square-foot Flushing Commons development.

The week’s mid-market deals fetched a total of $172.6 million, trouncing the prior week’s $38 million. Below are more details on transactions recorded in the first week of October:

1. Reuben Brothers subsidiary Metro International bought a 12,600 square-foot commercial condo unit at 40 East 66th Street for $30 million and a 12,200 square-foot, mixed-use building at 677 Madison Avenue in Lenox HIll for $20 million. Vornado Realty Trust sold the buildings, and other retail holdings, which it said had “negative income.” The Reuben brothers have been especially active in Manhattan since the start of the pandemic.

2. Land Finance Corporation, an affiliate of gun manufacturer Beretta USA, bought an 11,000 square-foot office building at 28 Howard Street, also known as 1 Crosby Street, in Soho for $21.75 million. Gilbert Spitzer sold the building. The Beretta affiliate sold 407 Park Avenue in May for $31 million.

3. Denali Management bought a 63,000 square-foot, mixed-use building with 109 residential units at 526, 530 and 534 East 138th Street in Mott Haven, Bronx, for $17.9 million. Martin Kirzner, a worst-of-2020 landlord according to New York City’s Public Advocate, sold the buildings through limited liability company Windsor Estates II.

4. Rivington Company LLC bought a 16,000 square-foot development site on six parcels — 122 Sanford Street and 723, 725, 725A, 727 and 733 Myrtle Avenue — in Bedford-Stuyvesant, Brooklyn, for $17 million. Ilan Cohen of Throop LLC sold the properties. Yaniv Cohen’s Leviathan Capital was planning a 129,000 square-foot building after Throop assembled the sites in 2019 for $13.58 million.

5. Abraham Moshel bought a 1,600-car parking facility beneath 138-35 39th Avenue in Flushing, Queens, for $16 million. The Rockefeller Group’s Rick Sondik signed for the seller, Flushing Commons Property Owner LLC, which developed the 1.8 million-square-foot Flushing Commons complex.

6. Jemstone Group affiliate 4612 Queens Boulevard LLC bought a

28,800 square-foot retail building at 46-27 Greenpoint Avenue in Sunnyside, Queens, for $14.25 million. Francine Israel signed for the seller, Israel Family Realty.

7. Limited liability company TDJ Holdings sold a 8,800 square-foot, mixed-use building at 51 East Houston Street in Nolita, and a 9,600 square-foot, mixed-use building at 217 East Houston Street on the Lower East Side, for $13.2 million. The buyer was limited liability company E. Houston Property Owner.

8. R.A. Cohen & Associates bought a 12,000 square-foot, mixed-use building at 445 Sixth Avenue and 101, 103, 105 and 109 West 10th Street in Greenwich Village for $12.5 million. Metro Management Development sold the properties, which have 17 residential units and 170 feet of retail frontage along West 10th Street.

9. Davean Holding bought 14,700 square-feet of mixed-use property at 15 and 17 South William Street, also known as 53 and 55 Stone Street, in the Financial District for $10.1 million. The buildings, which house two ground-floor bars and seven apartments, were two of three that Goldman Properties sold for a total of $16.1 million, the third property is located across the street at 52 Stone Street. Davean also owns a five-story, mixed-use building at 6 Stone Street down the block, which it acquired for $6.6 million in 2019.