This post originally appeared on tBL member SCGWest’s blog and is republished with permission. Find out how to syndicate your content with theBrokerList.

Restaurants:

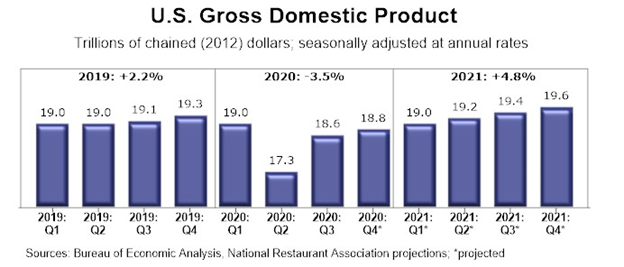

The latest trends in the restaurant industry indicate a recovery in the restaurant industry towards the end of this year. The National Restaurant association reported that they expect real GDP to exceed its pre-pandemic levels by the third quarter of 2021. It also projects that real GDP growth will expand to 4.8% by the end of 2021, which would be the highest real GDP growth since 1999.

The newest trend to arrive in the restaurant industry is the increasing popularity of ghost kitchens. CNBC reports that with regulations requiring limited capacity for in-door and outdoor customers, large restaurant chains like Chili’s and Applebee’s are launching virtual brands that rely on third party delivery companies like Uber Eats to deliver food to customers. CNBC is also reporting that the demand for ghost kitchens, or delivery-only restaurants, is skyrocketing. Each week, new companies emerge that offer food by delivery only. By cutting down on the square footage needed to house customers, ghost kitchens save money by only paying for enough space to fit a kitchen. Although this seems to be the cheaper method, the market for ghost kitchens is becoming increasingly saturated, making ghost kitchens more expensive to lease than usual.

Also, although operating a ghost kitchen seems to make more economical sense than operating a traditional restaurant, making one profitable is becoming more of a challenge. The profit margins from ghost kitchen sales are razor thin, given that third party delivery companies take hefty percentage of it. CNBC reports that restaurants pay third-party delivery apps a commission fee ranging from 15% to 30% for every order placed. This means that to become profitable, ghost kitchens are required to sell at an enormous volume to make up for there thin margins. This challenge is becoming more difficult, as new ghost kitchens continue to saturate the market.

An article in The Franchise Times explains another reason for the demand for ghost kitchen companies. It summarizes a report from Peter Saleh of BTIG who thinks that Joe Biden’s plan to raise the federal minimum wage to $15 will cause restaurant owners to transition to ghost kitchens in order to save on labor costs.

Retail:

In the retail world, CNBC reports that retailers have been ordering less inventory in order to avoid having excess inventory in case there is a COVID related decrease in demand. Although some retailers say they might have left money on the table by order too little inventory, given that demand during the holidays was greater than expected (8.3% higher than 2019), most brands have determined that due to uncertainty, not enough inventory is better than too much. The idea behind this is that excess inventory due to lower-than-expected sales requires major discounting to get rid of it. This hurts profit margins and the discount of apparel also hurts its branding. Because more and more retailers are taking this approach, off-price retailers that sell excess inventories like Ross and TJ Maxx are expected to take a hit.

Although retailers are currently taking precautions against lower demand, recent metrics indicate that they should prepare for increased demand in the future. Globe St. reports that “Vaccine distribution, historically low interest rates and pent-up consumer demand will all create a perfect storm” for retailers. Given this, retailers need to prepare for this “perfect storm” of radically increasing consumer demand once pandemic related restrictions subside.

Medical:

Although many would think that the medical industry would benefit financially from the COVID-19 pandemic, there are many sectors of the healthcare industry that have suffered because of it. This is mainly due to the fact that many consumers are choosing to avoid hospitals and medical offices for fear of contracting COVID. Globe St. reports that employment in the healthcare industry still remains below its pre-recession level and as of October, only 63% of healthcare jobs have been recovered.

However, the healthcare industry still has ample reasons for optimism. This is due to the fact that the 65+ year old age group is going to rise dramatically in the next coming years. Cushman & Wakefield predicts that over the next 10 years, this age group will increase at a rate faster than ever in history. This demographic shift is predicted to create a massive spike in demand for health care services. This, coupled with the fact that The Centers for Medicare and Medicaid Services predicts healthcare spending will increase to $268 billion per year by 2027, the healthcare industry remains promising.