The new lease accounting standard, ASC 842, addresses a number of hot topics you should be aware of as a lessee. One of these topics is how to treat lease incentives. This article will walk through the proper accounting treatment.

An executed lease agreement always involves two parties, the lessor and the lessee. Typically, the execution of that agreement involves some negotiation between the parties. One of the most common ways lessors motivate lessees to wrap-up negotiations and sign on the dotted line is by offering the lessee a ‘lease incentive.’

What is a lease incentive?

A lease incentive is a payment made from a lessor directly to a lessee, or on behalf of a lessee. As such, a lease incentive can come in many different forms and look like a lot of different things. Lease incentives do not include payments from the lessor to the lessee for any good or service that the lessee is providing to the lessor.

Common examples of lease incentives are:

- A lump sum cash payment from the lessor to the lessee at the date of lease execution

- A payment from the lessor to the lessee during the lease term to reimburse for leasehold improvements

- The lessor taking over a lessee’s pre-existing lease to entice the lessee to enter into a new lease with the lessor

Regardless of what it may look like in practice, if you are dealing with a payment from the lessor to, or on behalf of, the lessee, you are most likely dealing with a lease incentive.

It’s a lease incentive: How do we treat it?

Let’s take a closer look at one of the more common incentive scenarios: leasehold improvements.

Leasehold improvements

Typically, a lessee will want to update a space to fit their business needs before moving in. Leasing a completely empty floor, for example, would probably not be suitable for a growing business if they want to hit the ground running on day one. To that end, the lessee will usually spend some money on leasehold improvements to update the space and ensure it is a suitable space for their business.

The lessor will sometimes reimburse the lessee for those leasehold improvements. This is where we must pause and consider the proper accounting treatment for this reimbursement (payment from the lessor to the lessee) under ASC 842.

Proper accounting treatment is actually determined by whether the leasehold improvements represent a lessee asset or a lessor asset. In short, who owns the leasehold improvements? There are no bright lines here to make that determination, but if for example, the lessee is making improvements to the space with their own branding and they own those improvements, then the reimbursement from the lessor would be treated as a lease incentive under ASC 842.

If, however, the improvements represent a lessor asset, then the reimbursement for that expenditure would not be considered a lease incentive under ASC 842 and would involve different accounting treatment.

There are several factors to consider when making the lessor vs. lessee owned asset determination. Typically, when the lease requires the lessee to make specified improvements, those are considered a lessor asset. On the other hand, if the improvements are

- not required by the lessor,

- specific to the lessee, and/or

- can’t be used by a subsequent tenant,

then the improvements are most likely considered a lessee asset.

It’s important to note there is not a single determining factor here – all factors should be considered.

Leasehold improvements: Lessor asset

If the leasehold improvement represents a lessor asset, then the reimbursement is not a true lease incentive. Assume, for example, that the lessor contractually requires the lessee to spend $5,000 building the outdoor patio of the leased space. This work is done while the lessor is finalizing the building for the lessee (i.e. the asset is not ready for use by the lessee so the lease term has not commenced). The lessee would account for such an expenditure as prepaid rent, and any reimbursement from the lessor would then decrease that prepaid rent.

Any unreimbursed portion of the expenditure is then included in lease payments as detailed below:

To record lessee payment for lessor leasehold improvements prior to lease commencement

Note: The remaining $2,000 of the expenditure is treated as lease payments upon commencement

Leasehold improvements: Lessee asset

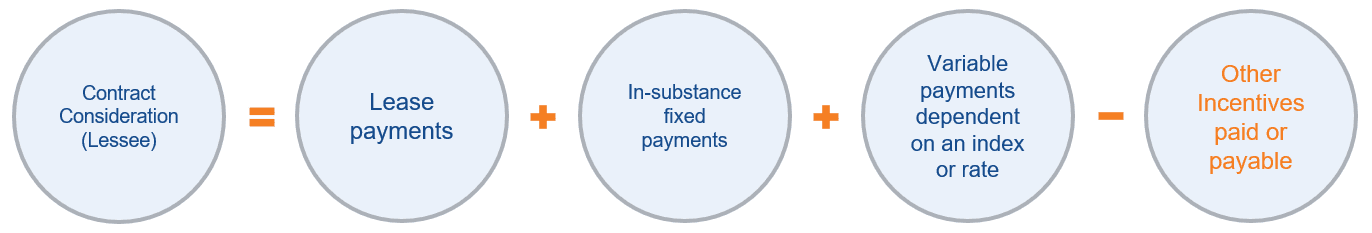

If the leasehold improvement represents a lessee asset, then the reimbursement is treated as a true lease incentive. Lease incentives are always included in the consideration in the contract according to ASC 842-10-30-5 and 842-10-15-35, as summarized below:

Since lease incentives are included in the calculation of consideration, they will need to be allocated between the components of the contract when there are multiple lease and non-lease components (unless the practical expedient to not separate lease and non-lease components is elected).

It is important to remember that lease incentives always decrease consideration in the contract (summarized above). The decrease to lease payments will affect a lessee’s opening lease liability, right-of-use (ROU) asset, and lease classification. With that said, let’s take a closer look at how incentives affect a lessee’s opening lease liability and ROU asset.

Lease incentive impact to opening lease liability and ROU asset

Up until this point, we’ve explored how to determine whether a leasehold improvement qualifies as a true lease incentive. Once you’ve made the determination that the leasehold improvement represents a lessee asset and the reimbursement from the lessor qualifies as a true lease incentive, you can focus on how lease incentives affect your opening lease liability and ROU asset.

Let’s take another look at the contract consideration graphic in the previous section. You’ll notice that lease incentives are described as ‘paid or payable’ to the lessee. You’ll also find this language in ASC 842-10-30-5. In this blog, we’ll discuss both types of incentives covered by ASC 842:

- Incentives paid at or before lease commencement

- Incentives payable at lease commencement

As the accounting for each type of incentive is different, we will demonstrate the accounting for both. First, we’ll walk through an example of an incentive paid at or before lease commencement. Second, we’ll take a look at an incentive that is payable at lease commencement, but not actually received until after the lease has started. Finally, we’ll consider what to do with incentives that are neither paid or payable as of lease commencement.

Lease incentive example: Paid at or before lease commencement

Lessee: Company XYZ

Lease Term: 1/1/2021 – 12/31/2030 (10-year term)

Base Rent: $150,000 annual payment on December 31st

Discount Rate: 3%

Lease Classification: Operating Lease

Incentive: $50,000 received from lessor at lease commencement (1/1/2021)

ASC 842-20-30-1 states, “At the commencement date, a lessee shall measure…the lease liability at the present value of the lease payments not yet paid, discounted using the discount rate for the lease at lease commencement…”

Using our LeaseQuery present value (PV) calculator below, ten $150,000 annual payments discounted at 3% results in a PVof $1,279,530. This amount is our lease liability at commencement.

The next step is to calculate the ROU asset. Per ASC 842-20-30-5, at lease commencement, the ROU asset consists of:

- The amount of the initial measurement of the lease liability

- any lease payments made to the lessor at or before the commencement date, minus any lease incentives received, and

- any initial direct costs incurred by the lessee.

Company XYZ received $50,000 in lease incentives at commencement. Therefore, in accordance with 842-20-30-5, the opening ROU asset is appropriately measured by subtracting the $50,000 in lease incentives received from the opening lease liability balance to arrive at the opening ROU asset balance in the amount of $1,229,530.

Journal entry recorded at lease commencement: 1/1/2021

Company XYZ will establish the opening balances noted above as well as the cash receipt of the incentive at lease commencement.

These opening lease liability and ROU asset balances are seen in the below amortization schedule.

Journal entries recorded at the end of Year 1: 12/31/2021

Before considering the incentive, Company XYZ will record the annual $150,000 cash rent payment to the lessor and the corresponding lease expense.

The entry to record the amortization of the lease incentive also results in a corresponding adjustment to lease expense is shown below:

These two entries result in a net lease expense of $145,000, equal to the lease expense shown in the amortization table above. As previously mentioned, lease incentives paid or payable always decrease consideration in the contract. Company XYZ will subtract the $50,000 of incentives received from the $1.5M of total cash payments, resulting in annual straight-line lease expense of $145,000 (($1,500,000 – $50,000) / 10 years = $145,000).

Finally, Company XYZ will reduce the lease liability, with an offset reduction to the ROU asset, to the present value of the remaining lease payments as of the end of year one, which is $1,167,916 per the amortization schedule above.

The entries from above are aggregated in the T-accounts below. You’ll notice that the ending balances highlighted in green appropriately tie to the amortization schedule (above) as of the end of the first year (2021).

Lease incentive example: Payable at lease commencement

Now we’ll use the same base example, except in this scenario the $50,000 lease incentive is payable to the lessee at lease commencement – receivable in two parts – $20,000 at the end of year one and $30,000 at the end of year two.

Lessee: Company XYZ

Lease Term: 1/1/2021 – 12/31/2030 (10-year term)

Base Rent: $150,000 annual payment on December 31st

Discount Rate: 3%

Lease Classification: Operating Lease

Incentive: $50,000 payable at lease commencement

- $20,000 to be received from lessor at 12/31/2021

- $30,000 to be received from lessor at 12/31/2022

At lease commencement, the lease liability is measured as the present value of the remaining lease payments. Furthermore, because lease incentives payable at commencement decrease fixed lease payments, the two installments of the incentive payable in years one and two will be netted against cash payments in their respective years for purposes of the present value calculation.

Using our LeaseQuery present value (PV) calculator again, the present value calculation for this set of facts equals $1,231,835, which represents the opening lease liability and ROU asset balance in this example.

Journal entry recorded at lease commencement: 1/1/2021

These opening lease liability and ROU asset balances are seen in the below amortization schedule.

Journal entries recorded at the end of Year 1: 12/31/2021

Similar to our first example, before considering the incentive, Company XYZ will record the annual $150,000 cash rent payment to the lessor and a corresponding increase to lease expense.

Company XYZ then records the receipt of the cash incentive at the end of year one in the amount of $20,000. Just as a cash payment would decrease the lease liability, the cash receipt of the incentive will increase the lease liability.

The entry to record the amortization of the lease incentive at the end of year one results in a corresponding adjustment to lease expense:

Finally, Company XYZ will adjust the lease liability, with a corresponding adjustment to the ROU asset, to the present value of remaining lease payments as of the end of year one, which is $1,138,790 per the amortization schedule above. The adjustment of $113,045 is calculated as the year one reduction of the lease liability ($93,045) plus the adjustment to the lease liability for the cash incentive received in year one ($20,000).

The entries we have walked through in this example are aggregated in the T-accounts below. You’ll notice that the ending balances highlighted in green appropriately tie to the amortization schedule (above) as of the end of the first year (2021).

Lease incentives: Not paid or payable

Lease incentives not paid or payable at lease commencement constitute a third category of incentives. These incentives are contingent on, or only receivable after a future event takes place. This category of incentive is not directly addressed in ASC 842. As such, there are multiple interpretations of the accounting treatment for contingent incentives.

One approach is to estimate the timing and amount of the incentive, and to treat it as payable at commencement using those estimates. Making an estimate like this assumes that the future triggering event(s) is/are within the lessee’s control and is/are reasonably certain to occur. If there is a subsequent difference in the timing or amount of the incentive received versus the original estimate, once that difference is identified, the lessee should then remeasure the lease liability and ROU asset using the most recent discount rate applied to the lease. This would be the discount rate applied at commencement unless the lease had since been modified, in which case the lessee would apply the discount rate used in the most recent modification.

It’s important to highlight that this is a remeasurement and not a traditional modification. ASC 842-20-35-5 indicates that a lessee does not update the discount rate when remeasuring the lease liability and ROU asset when the remeasurement is driven by a change in the lease payments resulting from the resolution of a contingency.

Summary

Lease incentive accounting: Easiest with a software solution!

Lease incentives are definitely one of the more complex and technical topics under ASC 842. Making these calculations in Excel can involve a lot of manual override and room for error. Simplify and automate this process by booking a demo with LeaseQuery today!