IFRS 16 summary

Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year, in accordance with the standard’s effective date of January 1, 2019, for annual reporting periods beginning on or after that date. Therefore, the standard is now effective for all organizations following international accounting standards.

This article will walk through the key changes between the lessee accounting model under IAS 17 and IFRS 16 and also provide a comprehensive example of lessee accounting under IFRS 16. The lessor accounting model under IFRS 16 remains relatively unchanged from IAS 17 and will not be covered in this article.

Note: This article has been updated for the benefit of organizations who have already transitioned to IFRS 16. Click here to read or download the previous version of this article, which includes two transition examples.

IFRS 16 leases

Within the lessee accounting model under IFRS 16, there is no longer a classification distinction between operating and capital leases. Rather, now a single model approach exists whereby all lessee leases post-adoption are reported as finance leases. These leases are capitalized and presented on the balance sheet as both assets, known as the right-of-use (ROU) asset, and liabilities, unless subject to any of the exemptions prescribed by the standard.

Similar to capital lease accounting under IAS 17, the accounting treatment for finance leases under IFRS 16 results in the recognition of both depreciation and interest expense on the income statement. For those entities dually reporting under both IFRS 16 and ASC 842, you will notice that the accounting for finance leases under IFRS 16 resembles the accounting for finance leases under ASC 842. However, ASC 842 still retains the operating lease classification.

In conjunction with the change in the lessee’s financial statement presentation, IFRS 16 also requires more robust disclosures.

What is considered a lease under IFRS 16?

Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in exchange for agreed-upon consideration. To determine whether a contract grants control of the asset to the lessee, the agreement must provide the following to the lessee:

- The right to substantially all economic benefits from the use of the asset

- The right to dictate how the asset is used by the entity

At times, an organization may have a contract that seems to meet the definition of a lease but does not fall within the scope of IFRS 16. Situations where this may occur include but are not limited to:

- Leases of biological assets

- Leases for the exploration of non-regenerative resources such as oil, gas, etc.

- Service concession arrangements

- Licenses of intellectual property

Concurrently, lessees reporting under IFRS 16 may choose to take advantage of practical expedients that exclude certain types of leases from capitalization. These include:

- Short-term leases, defined as having a term of 12 months or less at commencement and no option to purchase the leased asset

- Leases of low-value assets, defined as leases for which the underlying asset’s fair value (when the asset is new) is generally less than $5,000

Note: Please refer to our blog on practical expedients for more details on IFRS 16 expedients

IFRS 16 finance lease example

Since the majority of entities reporting under IFRS have already adopted IFRS 16, we will bypass a discussion of the various adoption methods and jump right into the accounting. For a breakdown of different adoption methods, please refer to our IFRS 16 detailed walkthrough.

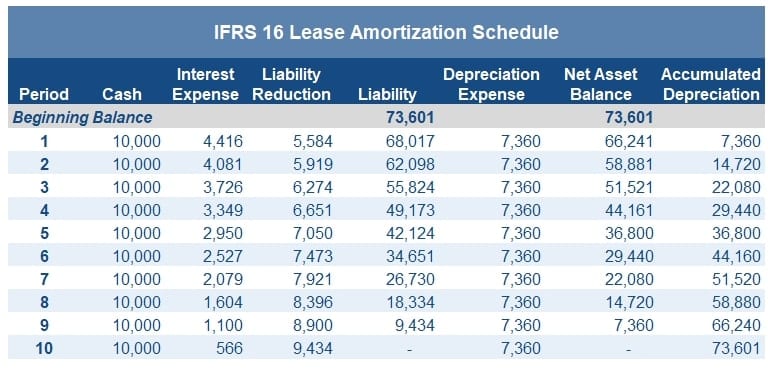

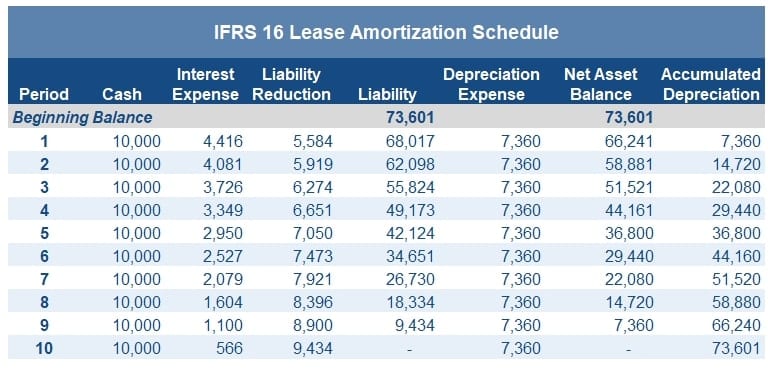

In the example below, we’ll outline the steps to calculate the lessee’s opening lease liability and ROU asset and present the complete amortization schedule, followed by the initial transition journal entry and the journal entry for the first period’s activity.

Commencement Date: January 1, 2021

Lease Term: 10 years

Lease Payment (paid in arrears): $10,000 annually

Lessee’s Incremental Borrowing Rate: 6%

Useful Life of Underlying Asset: 25 years

Amortization schedule

Based on the facts above, we’ll take the following steps to generate the IFRS 16 amortization schedule:

- Calculate the initial lease liability as the present value of the total remaining lease payments as of the commencement date.

- Calculate the initial right-of-use asset as the lease liability at commencement plus or minus any necessary adjustments.

- Amortize the lease liability over the lease term to reflect both lease payments and interest on the liability using the effective interest method.

- Depreciate the ROU asset in a systematic and rational manner over the useful life of the underlying asset or the lease term, whichever is shorter.

Using the values noted above, the amortization schedule at the commencement date of the lease is as follows:

To calculate the present value of the future lease payments, apply the lessee’s incremental borrowing rate of 6%. Per IFRS 16, lessees are encouraged to use the rate implicit in their lease. However, if that is not readily determinable, then a lessee is provided further leeway to use their incremental borrowing rate as we have done in this example.