This post originally appeared on Marketplace Advertiser, Reonomy and is republished with permission. Find out how to syndicate your content with theBrokerList.

CRE Lending Landscape Forum

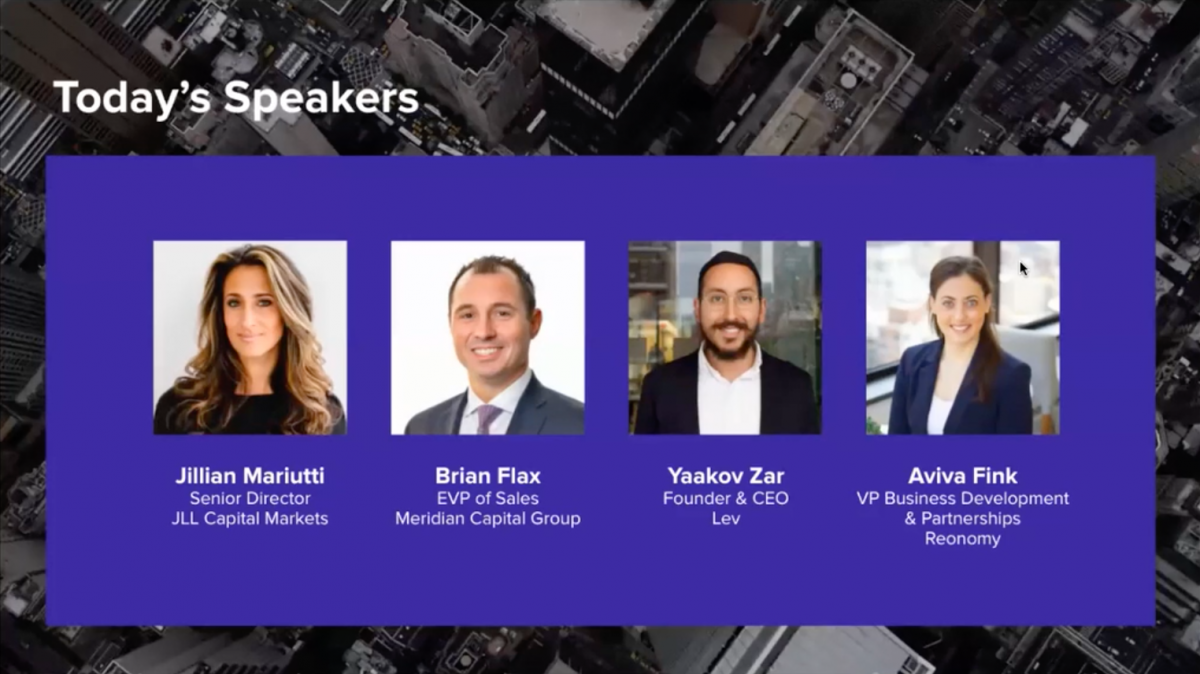

On August 4th, Brian Flax, EVP of Sales at Meridian Capital Group, Jillian Mariutti, Senior Director at JLL Capital Markets, Yaakov Zar, Founder & CEO at Lev, and Aviva Fink, VP of Business Development and Partnerships at Reonomy, got together to discuss the current state of commercial real estate lending, providing their respective expertise on industry and asset-specific trends.

To watch the forum in full, tune in here.

Below, we dive into the overarching themes of the discussion and highlight the key takeaways.

Theme #1: Increased Capital and Lending

Decreased lending in 2020 resulted in a large amount of capital sitting on the sidelines.

All in all, many CRE lenders expect to have a record year in 2021, as the economy begins to reopen and positive trends continue—for example, a majority of tenants paying rent.

Low interest rates are also making real estate loans and refinancing attractive to borrowers. As such, competition for deals is high.

According to Jillian, “In general, the debt markets are very liquid right now. We are seeing dry powder at record levels – $226 billion. For perspective, there was $80 billion in dry powder back in 2008. So, there are a lot of originations and a lot of debt for all asset classes.”

Yaakov agreed with Jillian, adding that there’s “a lot of money out there and people are competing hard on acquisition deals. They’re looking for financing to move quickly. I think speed is becoming more of a competitive advantage on every single transaction.”

Theme #2: Uncertainty for Office but Optimism for Other Sectors

Remote and hybrid work have taken a toll on the office sector, with the delta variant only adding to the uncertainty. The panel discussed, however, how many other CRE sectors are booming.

Industrial has seen a lot of optimism for the last 18 plus months, which is likely to continue. Single-family rentals, multifamily, cannabis, and life sciences are all doing well according to the panelists.

Environmentally friendly assets are performing well and are priced competitively. Interestingly, experiential retail is breathing life into the once seemingly dying sector.

And, while certain markets are doing extremely well, like South Florida, all three panelists see opportunity across the country, including in New York City.

Yaakov sees a large opportunity in single-family rentals, which “have been insane. We’ve seen a huge amount of institutional capital go into the SFR space. There’s also so much room to build the mom-and-pop and mid-market SFR portfolios. There’s a lot of capital there.”

On the topic of environmentally friendly buildings, Brian explains, “If a building qualifies as green, the agencies, which are government-sponsored programs trying to promote environmentally friendly construction and building upkeep in general, will give you pricing benefits. This pricing benefit could be 30 basis points.”

Along with the new to New York C-PACE (Commercial Property Assessed Clean Energy) program, pricing benefits for green buildings make environmentally friendly buildings attractive to many borrowers.

Theme #3: Data is Crucial in the Current Climate

The pandemic has highlighted how crucial data is to every part of commercial lending. Actionable data can help businesses involved in CRE make the right business decisions to grow their business and gain a competitive advantage.

Plus, data can help lenders serve their clients better and get them the best terms.

With so much competition for deals, all three panelists agreed that data is key to success in the current climate.

Brian doesn’t “see how you could be successful in this business today without not only subscribing to data and paying attention to data. But, also, having many people that are spending a lot of time sorting through it, understating it, synthesizing it, and then making business decisions and acting on it.”

In agreement with Brian, Jillian remarked that “knowledge is power, and the more information and access you have to all the different data and intel across the industry will make you better at your job. And, it will make you successful at getting your clients the best terms.”

Five Key Takeaways

- Due to pent-up pandemic demand, there is a lot of capital available. Commercial lenders are competing for deals, sometimes leading to more favorable terms for borrowers. Low-interest rates, though volatile, also incentivize borrowers either to finance new projects or refinance existing loans.

- Pandemic necessitated remote work has adversely affected office space. The current uncertainty makes the office sector an unattractive one. However, many other sectors are booming. Industrial has consistently done well in the last 18 months. The panelists are also bullish on single-family, multifamily, cannabis, life sciences, and experiential retail assets.

- While some markets are booming, like South Florida, there is also high optimism for many markets across the country. From Arizona to California, to even New York City, which is showing signs of recovery, all three panelists are optimistic about markets throughout the country.

- Environmentally sustainable buildings are a hot trend currently. C-PACE, which borrowers can qualify for by making green updates or bringing their property up to code, can help borrowers access efficiently priced proceeds. Agency financing will also provide pricing benefits for qualifying green buildings. This can help struggling sectors, like hospitality, increase liquidity or bring down the cost of capital.

- While 2021 will be a record year for many lenders, commercial lending is currently extremely competitive. To gain a competitive advantage and serve clients better, businesses in the CRE lending space need to use actionable data to make the right business decisions.