This post originally appeared on tBL member Meybohm Commercial’s blog and is republished with permission. Find out how to syndicate your content with theBrokerList.

If you’re considering a real estate investment, you’re probably asking yourself what the market rents are for a given property. So, how do you figure out the rental projections for a given market?

A rent study should answer that question and give you the tools you need to make an educated guess of where rents will go.

What is a rent study?

A rent study is a spreadsheet of rent comps, either asking rents or effective rents, with some basic information such as square footage and class of complex. For simplicity, multifamily rents are usually divided into “A”, “B”, and “C” class properties, and square footages can generally be found on Apartments.com or Apartmentfinder.com.

How do I conduct a rent study?

To start, determine the market or trade area that you want to study, and make a spreadsheet of various apartment complexes in the trade area. Add columns for beds/baths, SF, rent, and class of complex. You may also want to have a column for amenities, such as clubhouses, pools, and walking trails.

Now go online and see what are the asking rates for each of these units. With square footages, sometimes various websites will give you a range—I usually take the average of the two numbers in the range. Be wary of outliers! Sometimes “executive” or furnished units will throw off your numbers, but be persistent.

You can also conduct the rent study by phone. If you’re calling, you will still want to put your spreadsheet together and populate it with as much online information as possible. I always recommend being honest: Tell property managers you are conducting a rent study, and offer to send them a copy when it’s finished. (You should do this, not only to avoid being a liar, but so they will help you with comps next time.)

I usually confirm rents and basic rental details—and ask them anecdotally how many calls and showings they are receiving. How strong is demand? You might make a column where you note that although a given complex is asking $1.50/SF for its one-bedroom units, the manager gets many more calls for two bedrooms than for one. That is useful!

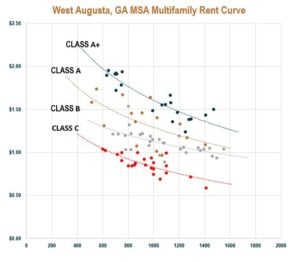

Once you have a meaningful compilation of rent comps, it’s time to turn it into a rent curve. I usually select the rent/SF and SF of the units in a given class (A, B, or C), and add a logarithmic trendline to those numbers. Then, I project forward a few hundred points and backward a few hundred points. This will give you a nice smooth curve that looks suspiciously like the ones from economics class (these are demand curves after all). Now you can match the units in question with their class peers on the graph, and use the information collected to estimate the market rents.

Congrats! Now you have a completed spreadsheet that looks like the example here: Download the Example Apartment Rent Study Here

And instead of guessing, you can base your projections on hard numbers. You may also be able to find some real anomalies in the market—undermarket rents—and some diamonds in rough. Good luck!

Copyright (c)2020 This post originally appeared in Jonathan Aceves’s blog and is republished with permission.

The post Need to Figure Out Market Rents? Here’s How appeared first on Meybohm Commercial.