Lease modifications occur frequently, and accounting for lease modifications is complex.

Separate guidance is provided for lessees and lessors. However, the remainder of this article will discuss the accounting treatment for a lessee.

Lease modification types

The proper accounting treatment for a lease modification depends on the nature of the modification. ASC 842 specifically distinguishes between two types of lease modifications:

- Lease modifications that give the lessee additional rights not included in the original lease (and are not accounted for as a new lease), extend or reduce the term of an existing lease, or change only the consideration in the contract

- Lease modifications that partially or fully terminate a lease by reducing the lessee’s right to use one or more of the underlying assets

Modification of existing lease vs. new lease

When first evaluating a lease modification, a lessee must ask themselves

- Does the modified contract contain a lease?

- If so, should the modified contract be accounted for as a new lease or a change to the original lease?

Sometimes a lease modification changes the scope or consideration of a lease so significantly it ultimately creates a new lease. Two conditions must be met for a lease modification to create a new lease. If both of the conditions are met, the lease modification results in two separate contracts. If the conditions are not met, the modified lease is not a separate lease. The two criteria are:

- The modification grants the lessee an additional right-of-use not specified in the original lease (for example, the right to use additional assets or additional floors/space in a building)

- The lease payments required for the additional right-of-use are consistent with the standalone price for the additional right-of-use, including adjustments for conditions that may be unique to the contract

It is worth noting here, if the modification solely grants the lessee the right to use the asset for an additional period of time, that modification would not create a separate lease contract, even if the extended term is at market value. This is because while the extension may allow the lessee to use the asset for longer, it doesn’t grant any additional rights. The extension is viewed as a change to an attribute of the existing right to use the asset already under the lessee’s control.

If the lease modification does not create a separate contract, the lessee remeasures the lease liability and right of use (ROU) asset at the modification date, and reassesses the following:

Modification to terminate all or part of the lease

If the modified terms of the lease agreement reduce the lessee’s rights to the underlying asset(s), then it is accounted for as a partial or full termination.

If the lease modification fully relinquishes the lessee’s rights to the underlying asset(s), the lessee accounts for the modification as a full termination. At the time of termination, the lessee removes the outstanding lease liability and ROU asset from their books. Whenever the carrying value of the ROU asset does not equal the lease liability balance at the termination date, the lessee recognizes a gain or loss through the income statement in the period of termination for the amount of difference. This is often the case in finance leases or in operating leases with built-in payment escalations or free rent periods.

If the lease modification only partially reduces the lessee’s rights to the underlying asset(s), this is accounted for as a partial termination. For example, if a lessee is leasing four floors of a building and then negotiates with the landlord in the middle of the lease term to reduce the leased space to three floors, the modified contract results in a partial termination of the original lease arrangement.

In this scenario, the lease liability is remeasured based on the new payment terms, and the ROU asset is reduced based on either the proportionate change in the lease liability or the proportionate change in the asset. For a full example of both approaches to reducing the ROU asset for a partial termination, check out our article on partial terminations under ASC 842.

Modification vs. reassessment

Reassessment related events

Lease modifications are often easily identifiable, as they require an agreed upon change in the contract between the lessee and the lessor. However, other potential events can occur throughout the lease term which require the lessee to remeasure the lease liability and ROU asset. Reassessments are required when an event does not involve renegotiation of the lease terms and conditions with the lessor, but when a change in the lessee’s facts, assumptions, or other circumstances related to the lease occurs. For example, a lessee may change its conclusion on the certainty of the exercise of a purchase or renewal option.

Reassessments can be caused by any of the events below:

- A significant event or change in circumstances occurs that is within the control of the lessee that changes the lessee’s certainty regarding exercising options to extend, renew or terminate the lease or purchase the underlying asset

- The contract is amended to require the lessee to change their conclusion(s) regarding the extension or termination of the lease

- The lessee reverses a previous decision regarding the exercise of the options in the lease

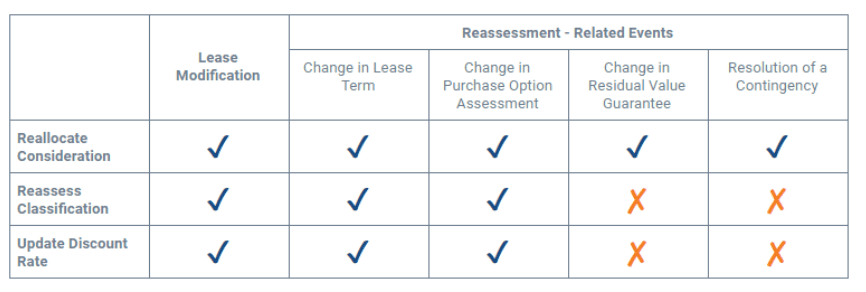

Modifications and reassessments both result in the remeasurement of the lease liability, however, the type of event dictates items such as whether the discount rate should be updated at the time of change, the lease classification should be reassessed, and consideration in the contract should be reallocated. See the chart below for a summary of the proper accounting treatments.

Modifications related to COVID-19 pandemic

In April 2020, the Financial Accounting Standards Board (FASB) discussed the impacts of COVID-19. Due to the expected number of lease modifications related to the pandemic, the FASB provided an electable alternative to requiring entities to treat lease concessions as a modification. The parameters of the available election options are outlined in this article regarding COVID-19 lease concessions.

Summary

Accounting for a lease modification, a change to the terms and conditions of a contract resulting in a change to either the scope or consideration for a lease, requires the lessee to evaluate a number of factors. Accounting for lease modifications was simplified with ASC 842, but still can be complex given the multitude of possible scenarios. Some of the scenarios outlined above require manual recalculation if performing the change in Excel, which can be cumbersome and susceptible to error. Therefore, companies may want to consider using a lease accounting software like LeaseQuery which can quickly give visibility into the impacts of lease modifications as well as the proper accounting for them when applicable.