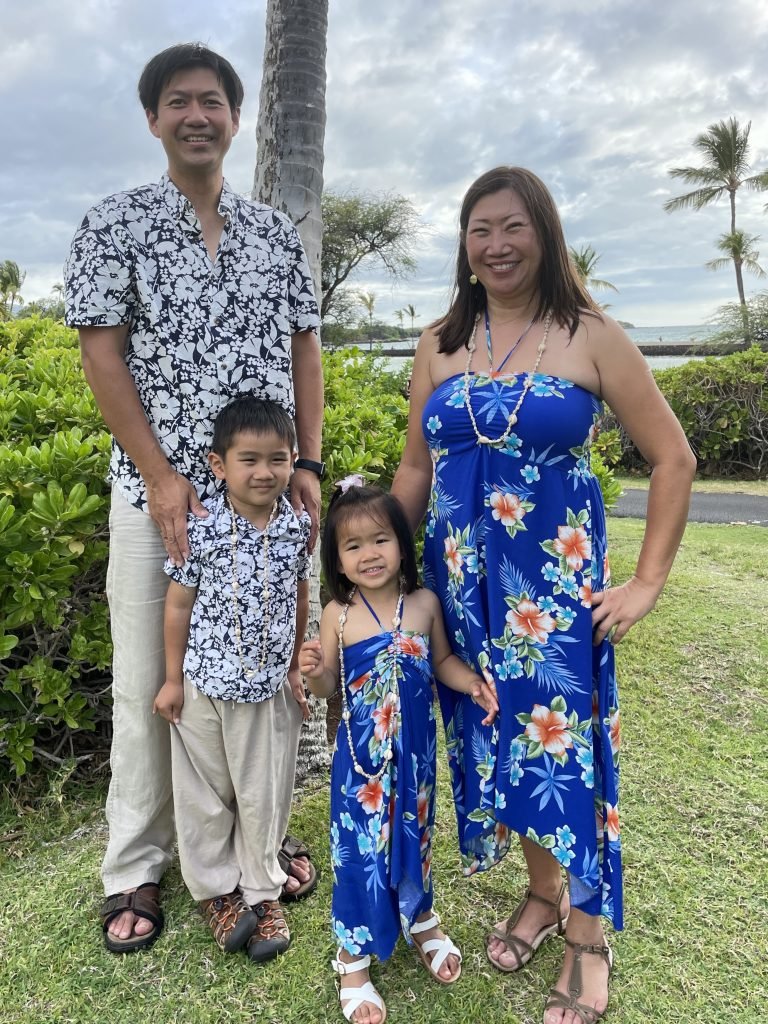

Hey everyone, I’m back! I missed making my last video since I was gone on vacation. I spent a week on the big island of Hawaii and had a great time.

But for those of you who have upcoming trips planned to Hawaii, be aware. COVID is spreading there quickly! The luau that we had planned to attend got canceled because one of the performers got COVID. We called another luau across town and theirs was also canceled for the same reason.

And the local shaved ice shop also had to close because one of their employees tested positive.

And to top things off, there were wildfires while we were there and we almost had to get evacuated from our hotel. I thought we were leaving the fires behind when we went on vacation! There were definitely some crazy-looking skies while we were there.

In the end, we didn’t have to evacuate. We got to enjoy the beaches, the hotel pool and did lots of activities that we all enjoyed. We all had fun, and we were glad to be able to go on a vacation for the first time in a year and a half.For my regular readers, welcome back! For those of you reading for the first time, I’m Mike Lin, and I’m a commercial real estate broker based in Southern California. I help owners of retail properties determine the value of their real estate and help to sell them for top dollar. And I make these YouTube videos to keep you updated on what’s happening in commercial real estate, the retail industry, the overall economy, and the state of California.

Today I’ll be talking about the state of chain retailers after COVID.

IHL Group repeated that study this year. Their research encompasses 945 publicly traded retail and restaurant chains with 50 or more locations. They gathered information from a variety of sources, including SEC filings, company web sites, press releases, and interviews.And they concluded that retail is doing very well in 2021 and is strongly bouncing back from the effects of the pandemic.

I’ll go over the key takeaways from their report. But first, it’s important to remember that their study focused on retail chains, not independent mom-and-pop businesses.

Before I dive into the details about retail chains, let’s recognize the devastating effects that COVID shutdowns had on small businesses.

An estimated $250 billion dollars of retail spending in North America switched from being paid to small retailers to larger retailers. The government forced small businesses to close while allowing larger retailers, many of which they deemed essential, to stay open.

Over 445 thousand small retailers shut down in the US and Canada. I’m sure that many of you who own shopping centers with mom-and-pop businesses had to deal with these challenges. Not all small businesses were able to survive, even with the help of the PPP loans and other government aid.But looking at retail chains shows a different, more optimistic view of the industry.

Here is the trend of store openings over the past 5 years.

Here we see a trend of net openings and closings in the past 5 years. And you can see that 2021 is shaping up to be the strongest year since 2017, with a net positive of 4,361 stores opening. It’s no surprise that 2020 was the most challenging year, with a net change of 6,573 stores closing.

Even before COVID, for many years, we heard a lot in the news about the death of retail and the retail apocalypse. It’s important to remember that news web sites try to sell clicks with attention-grabbing doomsday headlines, and people are 10 times more likely to click on a bad news headline than on a good news headline. But when you look at the overall statistics for store openings, the numbers really tell a different story from what the news headlines say – and retail is really holding its own.

The strongest performing segment of the retail industry is restaurants, which are expected to have a very strong year, with a net positive of over 1500 stores opening. Starbucks, Domino’s, and Dunkin are the chains with the most store openings over the past 5 years.

One of the biggest challenges for all of retail, and particularly restaurants right now is finding labor. Restaurant workers are quitting in droves, realizing that they are being underpaid and no longer want to stand on their feet all day or deal with poor working conditions.

Recently, an entire 11-person staff of a Burger King in Lincoln Nebraska just quit all at once and let their managers know by changing the sign outside the restaurant. So while the demand is there for more restaurants to open, there are certainly issues with getting enough workers. So restaurants need to pay more in order to hire and keep workers, and those costs are passed onto you, which is why your fast food combo meal now costs over ten dollars!Let’s take a look at how retail is doing by segment.

All categories have a net positive of stores opening in 2021, with the exception of department stores, which is no surprise, and specialty soft goods, which include clothing stores that are often found in malls – think like Children’s Place, the Gap, or Men’s Wearhouse. But overall, there’s a net opening of 4,361 stores.

Which retailers are opening the most stores?

The dollar stores lead the way, with Dollar General and Dollar Tree #1 and #2 on the list.

And of course, the Delta variant of COVID is a concern, as well, as it could affect foot traffic in many retail locations and keeping people at home for safety, even if the government doesn’t mandate shutdowns again.But overall, I enjoyed IHL’s report and it’s great to see this research being done that gives a fair look at what’s going on in the industry and has an optimistic outlook on the future.If you’d like to see the full slides from the study, or to buy the complete report, here is the link.Thanks for reading, and I’ll see you next time!