Author: Buildout This post originally appeared on Buildout’s Blog and is republished with permission. Find out how to blog with us on theBrokerList.

As a broker or CRE professional, you know that even when a listing is closed, the work isn’t done.

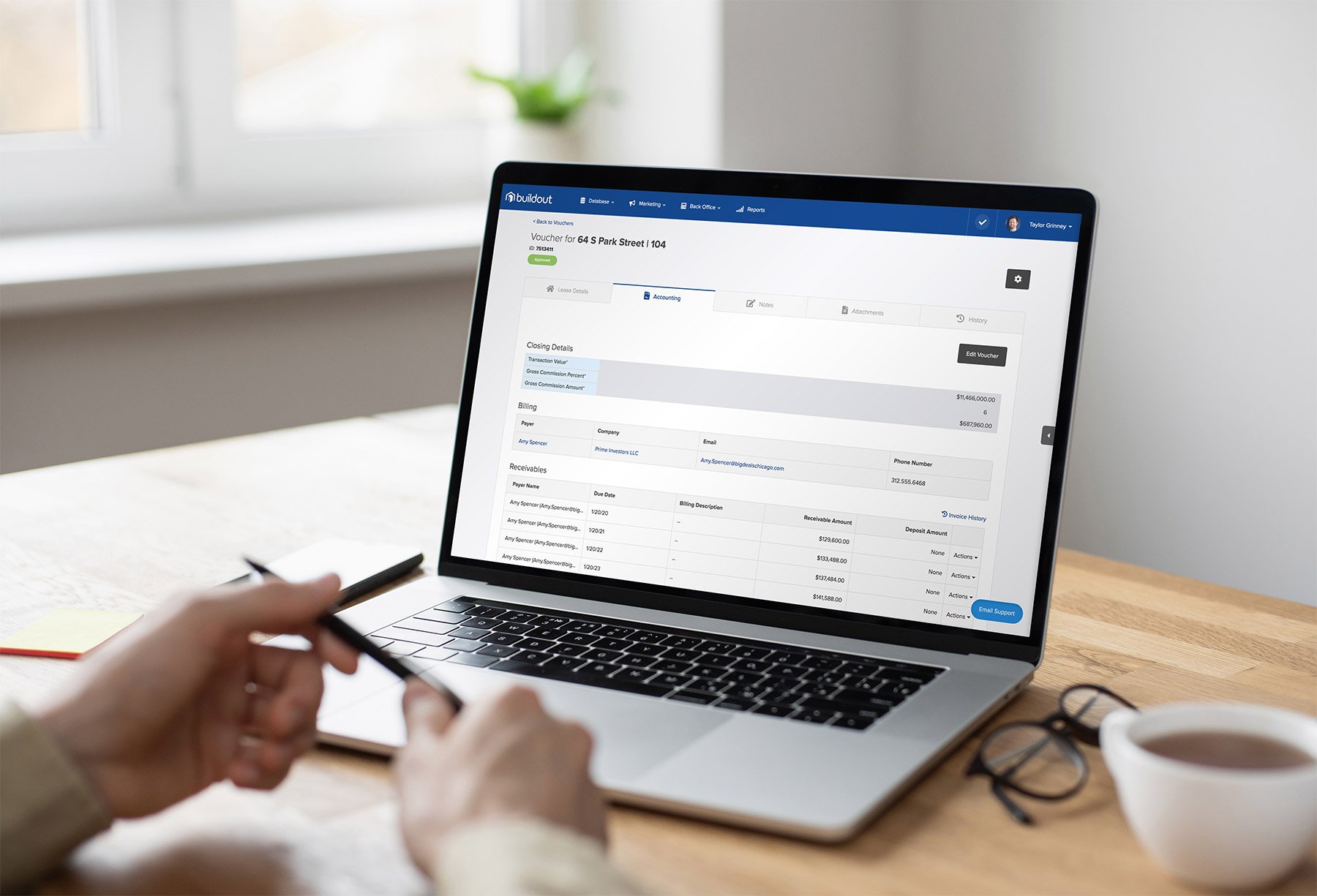

Your brokerage still needs to create and approve vouchers, calculate commissions, generate and send invoices, and collect payments to completely close the deal.

But many CRE firms manage all of these back-office processes manually, which is both tedious and time-consuming—often delaying the entire deal cycle.

CRE tech can change that—and here’s how:

Eliminate outdated spreadsheets

Time and time again, we learn that brokerages are dependent on outdated spreadsheets and separate software systems for their accounting processes.

There are a few problems with that: manual entry of transaction data is time-consuming, it is difficult to correlate incoming checks with outstanding invoices, and data can get lost.

But with brokerage back-office and accounting software, brokers and admins can store and access all data in one place, create prepopulated invoices from receivables, and track accounts receivable and payable as well as incoming checks for every deal—eliminating the need for those outdated spreadsheets.

Stop tracking down brokers

The admin or accounting team in charge of the back-office transaction processes at your brokerage is probably not familiar with the details of your deal, so they are often chasing down brokers to get the necessary information.

Back-office software connects your data across every stage of your deal so everything from contact to property data is available in your back office without ever having to re-enter a thing—in turn preventing delays in brokers being paid, clients getting invoices, and the firm taking its cut.

Ensure data accuracy

Historical comp data is extremely valuable because it informs all of your future deals. After closing a deal, you need to update your comps in your brokerage’s database with all data from your deal—and for many brokerages, this is a manual process.

With CRE software that integrates your CRM and comps database with your back office, you can push all data from your deal to your database for future reference. Not only does this eliminate data re-entry for every broker at your firm, but it also allows you to make informed decisions based on actual brokerage-wide comps data.

Reduce future research

After a deal is closed, you need to calculate commissions for each broker based on their tiers. But broker tiers are constantly evolving, and your admin or accounting team is probably managing tiers and commission cuts manually.

Centralizing broker tier and commission data is the solution to that problem. Back-office software allows you to set up as many different commission plans as you need and tier progress updates for each broker as deals are closed and processed—meaning commissions are calculated for you, automatically.

Understand the overall health of your brokerage

Understanding the overall health of your brokerage is crucial in commercial real estate. And if you are using a CRE software that lacks integrations, there are probably numerous steps to your reporting process.

But with a single, connected tool housing your entire brokerage’s work—you’ll have better insights than ever.

You can reduce the steps in your reporting process with automatically generated analytics, share important information across teams, and grow your brokerage through better collaboration.

Ready to integrate your brokerage’s full deal cycle?

With Buildout’s Back Office, you can improve processes and streamline your brokerage’s accounting by collecting vouchers, tracking accounts receivable and payable for every deal, and calculating broker commissions with one seamless back-office tool.

If you haven’t seen what Buildout can do for you and your team, get in touch with us and ask for a personalized demo today.

For more updates like this and future coverage of tools in the CRE industry and other brokerage insights, subscribe to our blog.