This post originally appeared on tBL member SCGWest’s blog and is republished with permission. Find out how to syndicate your content with theBrokerList.

Restaurants:

As of February, restaurant sales have risen for the first time in 4 months. According to a survey conducted by the National Restaurant Association, restaurant sales rose up 6.9% since December making it the largest monthly increase since June. Although sales are not where they were before COVID, this new development seems to suggest that the restaurant economy is heading in the right direction.

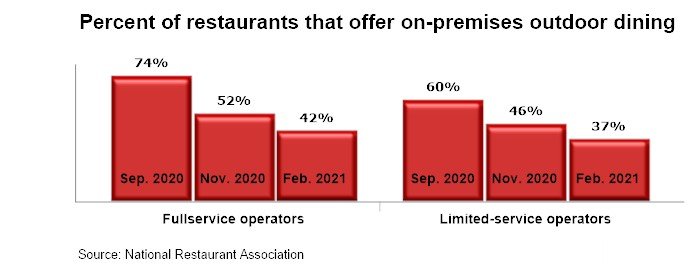

Of course, setbacks still remain. Unfortunately due to the recent drop in temperature, restaurants that were previously depending on offering outdoor dining are seeing less traffic. According to an additional survey conducted by the National Restaurant Association during February 2 through February 10, only 42% of full service operators said their restaurant offers outdoor dining. The good news is that winter is starting to come to a close and outdoor dining will start to come back to normal in the coming weeks.

On another note, restaurant menu trends have been fluctuating. An interesting piece from Full Service Restaurant Magazine indicates that at the start of the pandemic, restaurant owners were noticing that consumers were ordering less adventurous menu items and instead gravitating towards more core menu items. In the piece from FSR, Nate Weir, vice president of culinary at Modern Restaurant Concepts exclaims that he noticed at the start of the pandemic, “people were looking for some comfort and familiarity”.

During a time of incredible uncertainty, most consumers were not looking to try new things. Now that more and more people are getting vaccinated, the end of the pandemic seems to be within reach, and uncertainty has been limited, consumer food preferences are now becoming more adventurous with what is described as a “seize the day” attitude. Adding to this point is that many consumers sharpened their cooking ability while staying at home, heightening their expectations for restaurant culinary. Due to this trend, restauranteurs should begin to experiment with their menu and try out new recipes. After spending ample time eating familiar food items, consumers are eager for some change.

Retail:

Globe st. predicts that retailer developers will spend 2021 further adapting physical spaces to accommodate social distancing. Although many of these changes are happening as a reaction to COVID, many new physical changes are expected to stay for the future, regardless of how long COVID persists. For example, curbside pickup is becoming a must have for retailers because of its convenience. Another development, which goes hand in hand with curbside pick-up, is for retailers to adjust their parking lots for customers who buy-online-pick-up-in-stores (BOPIS). This trend is becoming increasingly beneficial for retailers. Retailers are finding that customers who come to retail stores to pick up items they ordered online are purchasing additional items within the stores they pick up their online items. Daniel Villapando from Cox, Castle & Nicholson points out that “80% of BOPIS consumers will shop for additional items while picking up their orders”.

Although many were pessimistic about retail store owners getting financing after the economic downturn of the COVID-19 pandemic, lending activity is starting to look up. Globe St. reports that financing for retail properties is heading in a positive direction for tenants. With the exception of fine dining and fitness centers, single tenant lease quick service restaurants (with drive thrus), drug stores, and medical properties are performing well and remaining financeable. At the same time, strip centers are also receiving financing, with the caveat that investors are typically requiring 85-90% occupancy of the centers with the majority of the tenants being national companies. Investors are becoming particularly careful that their tenants are able to pay rent at a time when the market is so volatile. At the same time, rent collections are looking up as they increased from 70% to 90% in the third quarter.

Another trend amongst retail developers is that many are now negotiating early lease terminations with struggling tenants. In Daniel Villapando’s report he explains that stores like Staples and PetSmart are willing to give up some space within their stores for other retailers. This allows more real estate for retail stores that are rapidly growing and do not require large amounts of square footage.

After receiving less demand due to the pandemic, many retailers are hoping the Biden administration will issue more COVID relief. Their hope is that not only small business loans going directly to retailers would be helpful, but the promised $2,000 stimulus checks would also help retailers. With 2,000 extra dollars on hand, consumers are likely to spend part of the money on shopping.