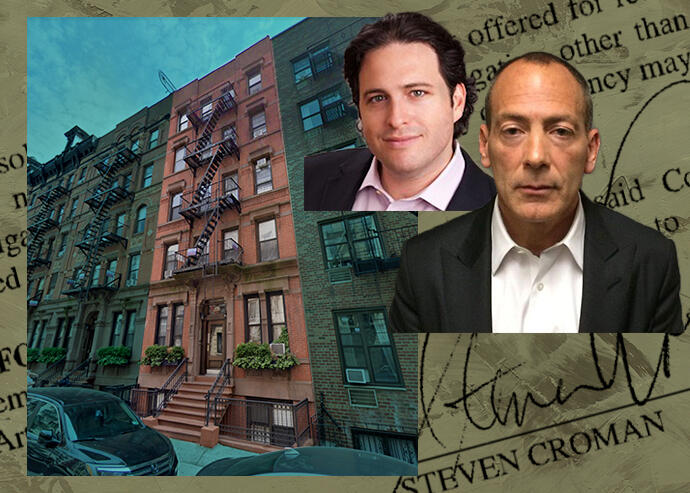

Mortgage Consolidation paperwork from the Office of the City Registrar, Croman, David Aviram of Maverick and 208 E 25th St. (Google Maps, City Registrar, ZoomInfo)

It’s lender versus landlord in a new lawsuit between two notorious players in New York real estate.

On Friday, hardball lender Maverick Real Estate Partners sued Steve Croman, an ex-con who has bedeviled tenants and lenders alike, to foreclose on his four contiguous Kips Bay apartment buildings.

The distressed-debt firm, which filed the suit just a day after acquiring the mortgage, demands Croman pay the outstanding balance of his $25 million mortgage, including 24% interest for the time left on the loan. It also aims to force a sale of the 85-unit assemblage at 208-214 East 25th Street, which Croman acquired in 2001, public records show.

Maverick bought the mortgage from BankUnited, a Miami-based lender, just a day before suing in New York Supreme Court. It alleges Croman defaulted on his loan twice, failing to move enough money into his BankUnited account in time for his July and August payments.

In March, a New York judge granted Croman an extension to finish paying off an $8 million tenant harassment settlement, citing hundreds of pandemic-related vacancies across his rental properties. It isn’t clear if he’ll use the same defense this time, as his lawyers haven’t responded to Maverick’s suit and Croman’s company didn’t reply to a request for comment.

The mortgage, issued in 2016, consolidated 10 loans into one $25 million omnibus. According to Maverick’s complaint, Croman owes more than $22.7 million on it. In addition to recovering its principal, the lender aims to capitalize on Croman’s two alleged defaults by imposing a host of fees.

Maverick demands both immediate payment and a prepayment fee — an aggressive stance even by the standards of New York real estate litigation. It’s also assessing a 5 percent late fee for the missed payments, and its 24% interest rate for Croman’s remaining tab is 1 percentage point short of New York’s usury limit.

The suit was filed by 25th Street Multifamily, an LLC registered to Maverick’s Park Avenue office. An affidavit signed by a managing director and an attorney from the firm confirms the connection.

A New York Supreme Court judge recently ruled against Maverick in a separate foreclosure suit over a $3.6 million mortgage in Chelsea.