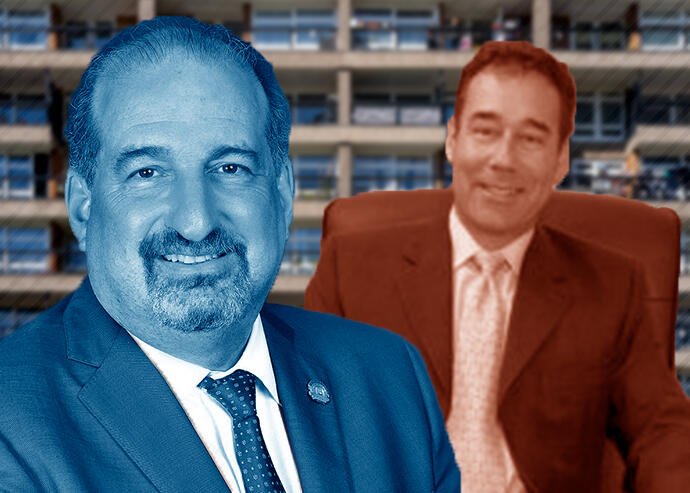

NAR CEO Bob Goldberg and Top Agent Network founder/CEO David Faudman (NAR, Top Agent Network)

After more than a year of litigation, the battle over the National Association of Realtors’ ban on off-market listings is over for now.

A federal judge permanently dismissed a lawsuit challenging the National Association of Realtors’ controversial policy, in effect since last year, that attempts to curtail so-called “pocket listings.”

The trade association’s Clear Cooperation Policy requires brokers to submit listings to a multiple listing service within a day of marketing a property to the public, preventing them from publicizing listings without making them available to other agents.

NAR’s board approved the policy in November 2019, arguing that it would increase transparency.

Some brokerage executives supported the move. Redfin CEO Glenn Kelman spoke out against pocket listings in May, arguing that they enable discrimination against minority homebuyers and provide an unfair advantage to brokers on the high end of the market.

In the lawsuit, Top Agent Network, a platform for the top 10 percent of agents in a market by sales volume, argued that the move was damaging to its business model, which profits off of giving those agents access to exclusive listings ahead of time.

Starting in May 2020, the San Francisco-based network slapped NAR with three successive antitrust lawsuits, each to no avail.

In a ruling filed Aug. 16, U.S. District Judge Vince Chhabria ruled that although TAN made a “reasonable” argument that the Clear Cooperation Policy was anticompetitive, it was in fact TAN that would run on an anticompetitive business model if the challenge succeeded.

“The Policy leverages NAR’s control of the real estate market to coerce most agents into giving up their off-MLS activities entirely, without regard to the competitive value of those activities,” Chhabria condeded, while noting that TAN’s model, which lets agents conceal listings from NAR’s subscribers while benefiting from NAR’s multiple listing service, undermined its case.

TAN agents can use information from NAR to make their public and exclusive listings more competitive, while agents who aren’t members of TAN don’t have access to that kind of intel.

Then, when sellers list homes with TAN agents without listing it on the MLS, competition for that home decreases, Chhabria said.

Thus, TAN was the wrong plaintiff to bring an antitrust suit over the policy, he said, as plaintiffs can’t use antitrust law to shield their own anticompetitive activities.

An antitrust concern could be raised, however, if the network were open to everyone and could show how the policy was causing members to leave, Chhabria continued.

“What TAN’s complaint fails to reckon with is that listings are just information, and competitive marketplaces generally thrive on open information,” Chhabria wrote. “Indeed, the point of the MLS is that such platforms are necessary for facilitating home sales. … And keeping that platform running and operational requires setting rules that ensure fair play among members.”

Chhabria went as far as to say that TAN used NAR’s MLS to help them achieve their top agent status, just to use the antitrust claims to “pull the ladder up behind them” and prevent other agents from doing the same.

“Instead of continuing to share listings with the open network of agents that supported their ascent, they would prefer to hoard choice listings among themselves,” Chhabria wrote. “Antitrust law does not give them that right.”

Despite the ruling, TAN CEO David Faudman maintained his stance regarding the anticompetitive nature of NAR’s policy.

“We feel strongly that NAR’s new MLS policy is bad for agents and bad for consumers and is just another anticompetitive attempt by the NAR to use its monopoly power to crush market alternatives,” Faudman said in an emailed statement.

The network’s legal team said that it would explore other ways to challenge the ruling, citing the points Chhabria alluded to about anticompetitiveness being a possible concern.

“It’s only a matter of time before this ill-advised rule is repealed or struck down,” TAN attorney Paul Llewellyn said in an emailed statement.

For NAR, on the other hand, it was a win.

“This is another example of courts finding that independent local broker organizations benefit competition through open markets by providing transparency that enables price and quality comparisons across all listings within a market,” said NAR spokesman Mantill Williams.