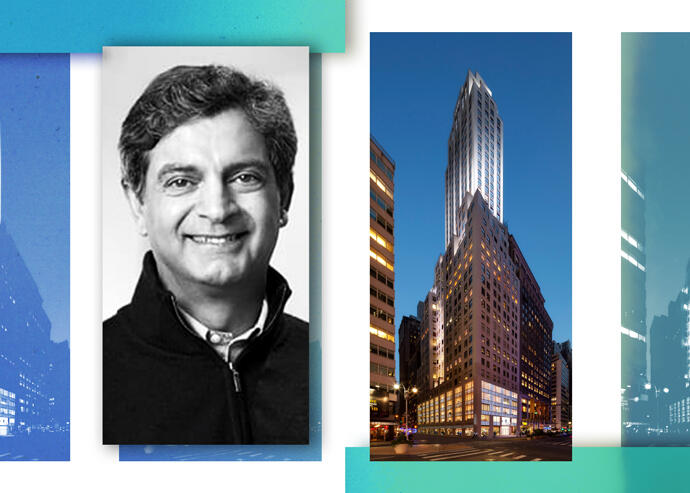

1450 Broadway and WeWork CEO Sandeep Mathrani (JLL, WeWork)

The following is a preview of one of the hundreds of data sets that will be available on TRD Pro — the one-stop real estate terminal that provides all the data and market information you need.

When WeWork began leasing at 1450 Broadway in October 2018, it had just become Manhattan’s biggest landlord. It was arguably its most important tenant, too.

One corporate meltdown and global health pandemic later, WeWork has lost its luster, but it is still writing checks at lots of buildings including the one at the corner of 41st Street and Broadway, where it occupies 62,000 square feet.

Bobby Zar’s ZG Capital Partners, which as fee owner of 1450 Broadway just returned to lenders for another refinancing, will use $215 million from a commercial mortgage-backed securities loan to retire $168 million of existing debt and cash out $23.8 million in equity. Documents associated with the securitization provide an inside look at the property’s finances.

The 440,000-square-foot office tower is 83.2 percent leased to 36 tenants, according to credit rating agency DBRS Morningstar.

Other tenants include apparel company Studio One, an affiliate of the owner, and brand management firm Iconix, whose brands are sold in Target, Macy’s, Kohl’s and JCPenney.

After WeWork, apparel companies make up 1450 Broadway’s next four largest tenants. Publisher Penguin Random House is seventh with 11,300 square feet.

ZG Capital Partners, a Zar Group affiliate, acquired the building in 2011 for $208 million. While the building remains largely occupied, with WeWork’s lease lasting until 2035, it will likely be tested by the shifting winds in the office market.

Over the course of its five-year, interest-only CMBS loan, 46.1 percent of rents are scheduled to expire — a high figure as companies debate returning to business as usual or maintaining a workforce-at-home.

On the other hand, should lease renewals continue to decline, it could signal more businesses seeking the flexibility WeWork and its kind offer. WeWork’s office occupancy rate recovered to 53 percent at the end of May, up from 47 percent late last year, though still well below its pre-pandemic norm of 70 to 80 percent.