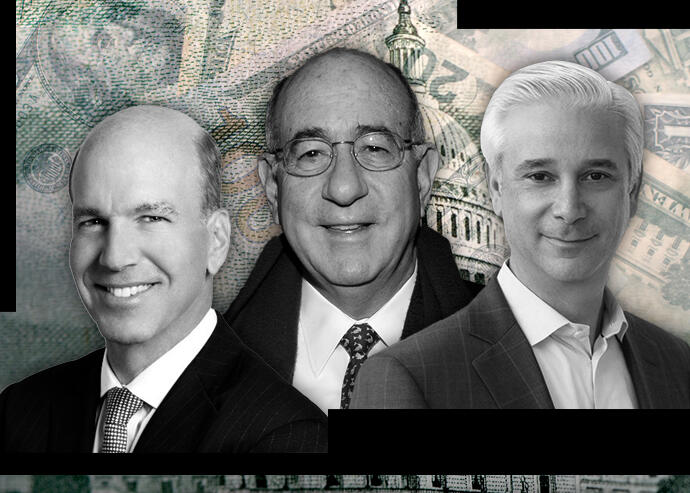

Taconic Capital Advisors’ principals Frank Brosens and Ken Brody and Wells Fargo CEO and president Charles Scharf (Getty, Taconic Capital, Wells Fargo)

Taconic Capital Advisors filed a $400 million suit against Wells Fargo alleging the financial giant failed to protect its investment in residential mortgage-backed securities, despite knowing many of the loans could be worthless.

In a complaint filed in New York Supreme Court, Taconic accused Wells Fargo of breach of contract for doing nothing to fix problematic documentation for a number of home loans that were bundled into trusts and resold to investors. The global investment firm poured $390 million into buying certificates for 27 of the trusts for which Wells Fargo was the trustee and contractually obliged to act in investors’ interest.

Taconic said the bank was fully aware that many of the loans that made up the trusts’ collateral had missing or fraudulent documentation. That meant if homeowners defaulted on their mortgages, the trusts would have to write off their losses because they wouldn’t be legally able to mitigate their losses by either foreclosing on the home or modifying the mortgage. To do either, the trust and any parties it hires to manage its portfolio of loans must show a prescribed set of documentation.

The 27 trusts in which Taconic invested bundled together more than 143,500 home loans valued at the time at $32.2 billion. The mortgages originated between 2005 and 2007, just before the housing market crashed. By March of this year, the trusts had lost more than $9.8 billion, according to court documents.

Wells Fargo knew many of the underlying loans didn’t have proper documentation, Taconic said in the complaint, because the bank inventoried them and sent notices to lenders asking for documents it was missing. Yet when the bank’s letters went unanswered, “Wells Fargo sat on its hands and did nothing,” a breach of the bank’s obligations to investors, Taconic wrote in the filing.

Claims about shoddy documentation jumped during the 2008-2009 housing crash, when banks and other financial institutions created fraudulent documents so they could foreclose or modify home loans borrowers couldn’t pay. The widespread practice known now as the robo-signing scandal led to a landmark 2012 settlement in which five of the institutions handling the largest number of underperforming home loans were fined $25 billion by federal and state attorneys general. The institutions fined included Wells Fargo, Bank of America Corporation, JPMorgan Chase and Ally Financial (formerly GMAC).

In Taconic’s suit, the firm said many of the 27 trusts were serviced by institutions fined in 2012 or subject to other litigation for misconduct in properly documenting home loans.

“Because Wells Fargo itself was engaging in the same illicit and improper acts as the servicers for the trusts,” wrote Taconic’s lawyers. “Wells Fargo knew that, if it began demanding repurchase of the massive numbers of loans containing document defects in the trusts, this approach could cascade through the industry.”

The bank’s failure to protect investors “can only be explained by the incestuous nature of the RMBS industry,” Taconic said. The investor went on to describe the industry where major banks such as Wells Fargo, which originates home loans, bundles those loans into trusts and then acts as a trustee and servicer, as an industry built on “quid pro quo relationships” in which they rely on each other for business.

A representative for Wells Fargo didn’t respond to a request for comment. Taconic’s attorney, John Lundin, declined to comment.