With commercial real estate just beginning to recover from the COVID-19 pandemic, the looming possibility of significant tax increases creates a new challenge for CRE developers and investors. But a niche asset type has emerged as a solid investment choice: commercial office condos. According to a recent market report on office condo sales in the second half of 2020, buyers have re-emerged, regaining confidence in the market and recognizing the impact of both the development of viable COVID vaccines and a potential overhaul of the US tax code. In the second half of last year, office condo sales saw a 73% increase in dollar volume over the first half of the year.

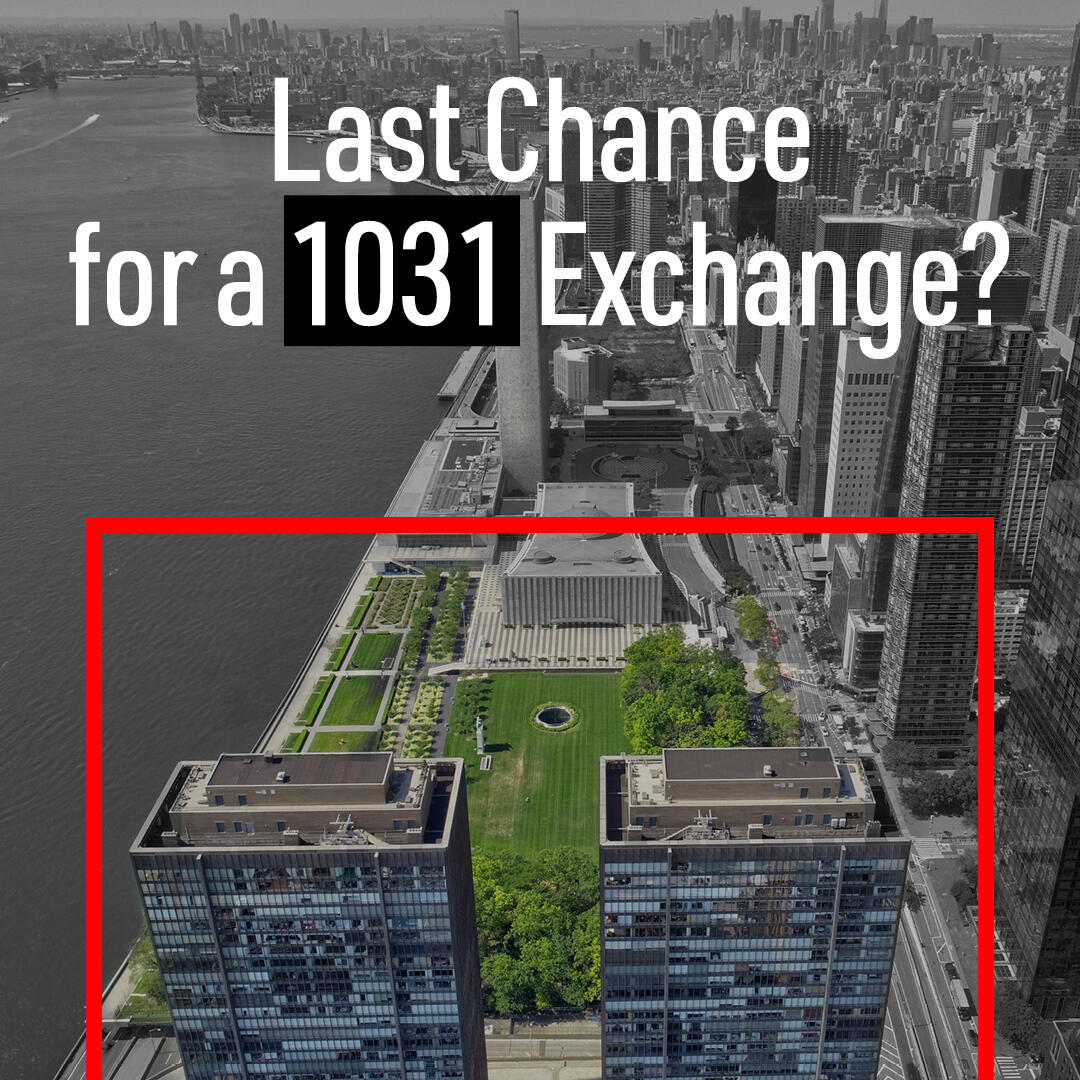

A recent blitz of transactions at 866 United Nations Plaza seems to be part of a larger renewed interest in office condo ownership, with one of the larger transactions of 2020 being the sale of an occupied 13,000-square-foot unit to a consortium of investors as part of a 1031 exchange. The space has been leased by the Consulate and Permanent Mission of Vietnam since 1997. Other recent sales include an expansion purchase by a current owner, as well new purchases by a non-profit and a financial services firm.

“Buyers recognize the overall value of investing in 866 UNP,” said Jared Horowitz, Vice Chairman at Newmark and part of the 866 UNP sales and marketing team. “The building’s sound fundamentals, along with stable long-term tenants in place, make these types of purchases a compelling investment for the buyers. Despite the unprecedented effects of COVID-19 on New York City, there has been continued interest from a variety of users, such as medical and educational organizations, as well as investors seeking stable assets that can deliver an attractive ROI. We expect that interest to increase as prospective buyers learn more about the innumerable benefits of commercial condo ownership as the current business climate continues to evolve.”

Leased investor units at 866 UNP are a unique investment proposition, with long-term government tenants in place that are far more insulated from the economic impacts of COVID-19 than traditional office users. Most of the investor spaces have been occupied for decades and have steady positive cash flow and are easily financeable. On a longer term basis, the historical appreciation and insulation from market volatility is particularly appealing: over the past decade, office condos have seen a 42 percent increase in value, according to a recent market report, which means there has never been a better time to buy than right now.

The recently completed capital improvement plan has given the building a major facelift, enhancing appeal to both current occupants and prospective users. Renovations include a new lobby with a curated digital art display, new elevator landings and cabs, new restrooms, new water fountains, and a variety of new amenity spaces commonly found in coworking or flex space buildings including lounges, breakout areas and phone booths. The sponsor also offers complimentary construction management services, helping smaller users navigate designing and building their floors more efficiently. The building’s waterfront location has also proven to be a key selling point for office condo ownership, boasting unobstructed panoramic views of the United Nations and East River.

Available units for sale at 866 UNP range from 500 to 61,000 square feet, with leased investor units from 3,459 RSF, move-in ready units from 2,600 to 10,310 square feet, and up to 100,000 square feet of contiguous available space. For more information on the opportunities available, visit 866UNP.com