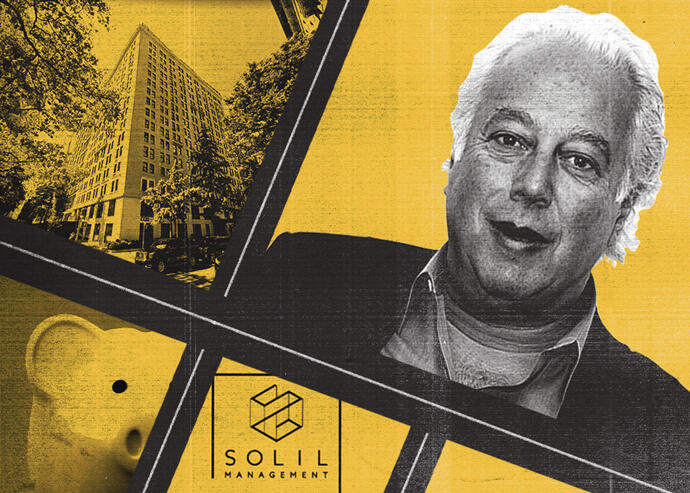

Aby Rosen and the Gramercy Park Hotel (Getty, Google Maps)

In December, Aby Rosen’s RFR Realty faced eviction from the Gramercy Park Hotel when it fell nearly $1 million behind on ground lease payments.

Now, landlord Solil Management, which owns the dirt under the iconic hotel, wants to terminate RFR’s long-term lease and collect the $79.5 million it’s owed under the terms of the deal, according to a lawsuit filed Friday in New York Supreme Court. RFR owns the hotel itself but pays Solil more than $5 million a year to lease the land.

Solil, which represents the estate of Sol Goldman, and RFR did not immediately respond to requests for comment.

Solil says that in October 2006, RFR signed a 72-year ground lease, allowing it to operate the hotel through 2078. (In 2010, Rosen bought out partner and friend Ian Schrager, taking full ownership of the hotel, which became a hot spot for fashion and art events.)

RFR attempted to renegotiate the lease with Solil in the summer of 2019, claiming the city’s hotel market dropped so precipitously that it rendered the leasehold “worthless,” according to the complaint.

At that point, Solil claims RFR also began removing valuables from the hotel. Those included furniture, along with Rosen’s art collection it advertised on the website, the filing claims. RFR also allegedly ceased making its rent and tax payments.

Solil says that “Rosen has chosen not to operate the Gramercy Park Hotel and has kept it closed to paying guests” amid the pandemic. Instead, he’s been quoted saying he’s offered free rooms and breakfast to employees so they can continue working in RFR’s office without commuting.

That follows years of RFR and Rosen using the hotel for “their own personal gain,” the complaint states. Solil alleges that for years, Rosen allowed his mother to live in a three-bedroom suite for free. The lawsuit also contends Rosen wined and dined guests at Danny Meyer’s pricey Maialino restaurant in the hotel, all expenses paid.

It contends RFR has not invested in maintaining the hotel, which has “deteriorated to a shocking degree,” according to the filing.

Court records allege that RFR, along with Rosen, have the funds to pay rent. In addition to income from other properties, the company received $6.3 million in federal Paycheck Protection Program loans in the last year.

Solil served RFR with a notice of cancellation and termination, ending the lease as of March 17. Still, RFR has not cooperated, the suit says.

RFR’s rent was expected to escalate in the coming years, reaching $5.6 million in 2024 and $8.4 million in 2068.

It isn’t the first time Rosen has faced claims of default and overdue payments.

In 2017, he faced foreclosure at Lever House at 390 Park Avenue as escalating ground lease payments made it difficult to refinance a $110 million loan. Ultimately, a partnership between Brookfield and Philip M. “Tod” Waterman III of Waterman Interests took over the office building.

Last summer, Rosen was months behind on payments for a $25 million commercial mortgage-backed securities loan for four commercial condo units at the base of the Core Club, which he had purchased in 2016.

The hotel industry in New York City has been ravaged by the pandemic. About 80 percent of hotels backed by the CMBS loans have shown signs of distress, exceeding the national average of 71 percent.