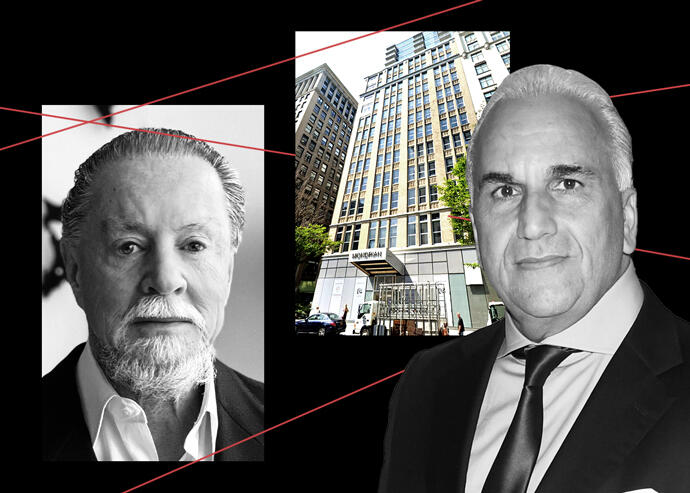

Eyal Ofer, 444 Park Avenue South and David Moin (Ofer/Wikimedia, Google Maps, Getty)

As the city’s hospitality industry looks to recover from the pandemic, the owner of NoMad’s Mondrian hotel is trying to negotiate a path forward with its new lender.

Moin Development is in talks with Eyal Ofer’s Global Holdings Group to work out a solution to its debt at the boutique hotel.

“We’re in discussions with them at this time, trying to work something out with the Global people,” Moin president David Moin told The Real Deal.

Global Holdings bought the $115 million mortgage on the property for close to par in a sale brokered by Adam Spies and Dan O’Brien at Cushman & Wakefield. A spokesperson for Global Holdings did not respond to a request for comment and a representative for the Cushman team declined to comment.

The Mondrian Park Avenue’s financial situation is not exactly clear, but it has suffered like nearly every other hotel across the city. The 190-room hotel at 444 Park Avenue South shut down in 2020 before reopening last June, though travel to New York City has yet to rebound.

Hotels across the city are reopening, though travelers are coming back slowly. The city’s tourism agency, NYC & Company, is working on a $30 million advertising campaign to woo tourists back to the Big Apple. It hopes to draw 10 million visitors this summer.

As far as hotels and their lenders go, there hasn’t yet been a big wave of distress tied to the sector, mostly due to New York’s foreclosure moratorium on commercial properties, which runs through Aug. 31.

There have been some UCC foreclosures, though, and a number of owners have simply walked away from their properties. Those that do hang on face a long recovery ahead.

Hotel operators in the city were charging about $185 a night in mid-June, a senior director at the hotel research firm STR recently told the New York Times. That’s just below the average operating cost.