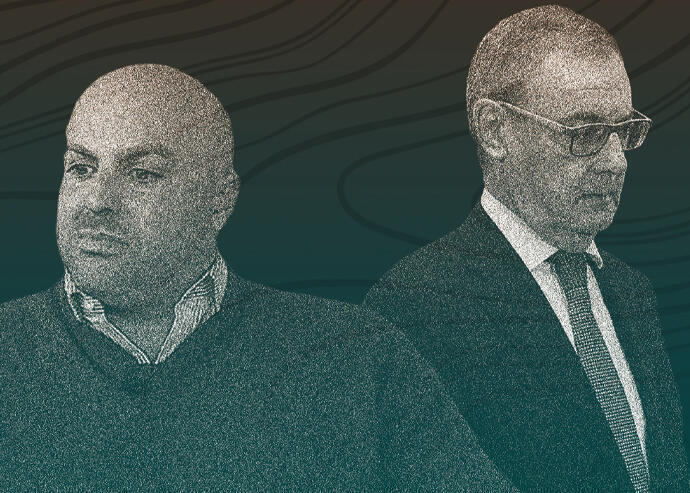

Churchill Real Estate’s Justin Ehrlich and Oaktree Capital’s Howard Marks

When Howard Marks’ Oaktree Capital set out to raise billions of dollars targeting troubled debt last spring, loan defaults seemed inevitable. Companies were teetering, people were hunkered inside and travel had come to a halt.

“The firewood had been stacked,” Oaktree wrote in its presentation to investors. And the coronavirus was the lighter. Billions of dollars were raised at a record rate eyeing distress opportunities.

Marks, whose memos are closely read by Warren Buffett, saw the flames of distress burn quickly. Within a few months, the Federal Reserve’s massive buying spree, combined with government stimulus, had squelched distress opportunities in real estate and elsewhere.

“There has been some limited distress out there, but nothing what they [investors] thought was out there,” said Brian Stoffers, CBRE’s head of global debt and structured finance.

But a year into the pandemic, many investors still see dark clouds ahead and opportunity on the horizon.

As of March 23, U.S. private equity funds had about $76 billion for distressed debt, according to Preqin. And so far this year, North American real estate funds have raised $5.1 billion to target distress assets, on pace to far exceed the $8.2 billion raised in 2019.

Distress funds

At the beginning of the pandemic, much was made about the wave of distress and the mountain of dry powder funds would use to take advantage.

Investors had flashbacks to 2008, when firms were able to seize on market crashes, acquiring properties for pennies on the dollar. This time, private equity firms closely eyed the debt market as lenders faced margin calls from banks, forcing them to unload loans and mortgage backed securities.

Investors funneled money into firms such as Los Angeles-based Kayne Anderson Capital Advisors, which was able to raise $1.3 billion for its debt fund in about two weeks.

But at the end of 2020, distressed asset sales accounted for just 1 percent of total real estate sales, according to Real Capital Analytics.

But at the end of 2020, distressed asset sales accounted for just 1 percent of total real estate sales, according to Real Capital Analytics.

“Very little of this distressed debt has transitioned over to distressed asset sales that investors are hoping to see,” said Jim Costello at Real Capital Analytics.

One issue is that the distress returns are just not there yet. In 2008, distressed debt funds brought in median returns of about 15.2 percent. Those returns dropped to about 10 percent in 2016, according to Preqin.

Will Sledge of JLL said distress debt funds are seeing their unlevered returns — returns without considering financing — around possibly 6 or 7 percent.

“Which really does not equate to a massive discount,” he said.

Some investors initially seeking out distress, including Oaktree and Kayne Anderson, are finding success in their so-called “opportunity funds.” Instead of a specific mandate to target distress, opportunity funds target broader mandates in addition to just depressed pricing.

Cerberus Capital recently closed on $2.8 billion for an opportunistic real estate fund — exceeding its target of $2 billion. Meanwhile, Oaktree closed a $4.7 billion real estate opportunities fund.

Ares Capital Management raised $1.7 billion of capital for its real estate opportunity fund. Some of those funds have already gone into hot asset classes, including two industrial investments and student housing at Texas A&M University.

Kayne Anderson is focusing on lending to areas that banks are backing away from, such as senior housing. Alternative lenders such as New York-based Madison Realty Capital have found a niche in providing financing to other alternative lenders who struggle to get financing from banks.

Madison Realty Capital’s Josh Zegen said that banks are no longer as nimble. “There is a lot of flexibility needed,” he said.

Outliers

There are opposing camps when it comes to distress. There are those who believe that all will be okay. Struggling property owners will get by on bridge loans and bank accommodations until they can pay off their debts.

Then there’s the glass half empty camp: those that believe that distress is hidden beneath the shiny glass facades of condo towers and office buildings — and especially retail. And, most importantly, banks and lenders will mark down loans, forcing distress sales.

Justin Ehrlich of Churchill Real Estate said he has found a niche in the pandemic by targeting debt tied only to New York real estate. He said his firm raised $2 billion in investment capital last year.

Ehrlich said he will often look at acquiring mezzanine loans, debt that gets paid back after the senior loan. By purchasing defaulted mezz debt, Churchill can foreclose on the property and effectively become the owner.

“Pretty much every sector in the New York City market is in distress, so the opportunities have been plentiful,” Ehrlich said.

In South Florida, Philip Blumberg is raising a $1 billion distressed fund in the hopes of finding discounts of up to 35 percent. American Ventures Partners is targeting high-end office properties across the Southeast. The real estate investor believes that office valuations will start to decline, leading banks to mark loans as problematic or “non-performing.”

“There is increasing pressure on banks on non-performing loans,” he said. “Banks are getting more and more concerned.”

There are indicators that distress could be heading down the pipeline. Real Capital Analytics projects there could be $146 billion in outstanding and potential distress. For the hardest hit sectors such as lodging, loans are severely stressed with delinquencies at 15.95 percent, according to loans tracked by Trepp.

Some distress funds are callable, meaning investors can try to retrieve their initial investment if things don’t materialize, said David Lowery, head of research insights at Preqin. He added that fund managers could get more aggressive about how they are going to invest.

Still, he said it was “early on in the distress cycle.”

Marks of Oaktree called it a “challenging” time for general distressed investing in an April 5 interview with Bloomberg. In a recent investor note, Marks said that the past year changed many things about the world, but the underlying truth of investing remains the same.

“There is no magic answer, no solution, other than superior skill, that will enable an investor to earn a high return safely and dependably,” he said.