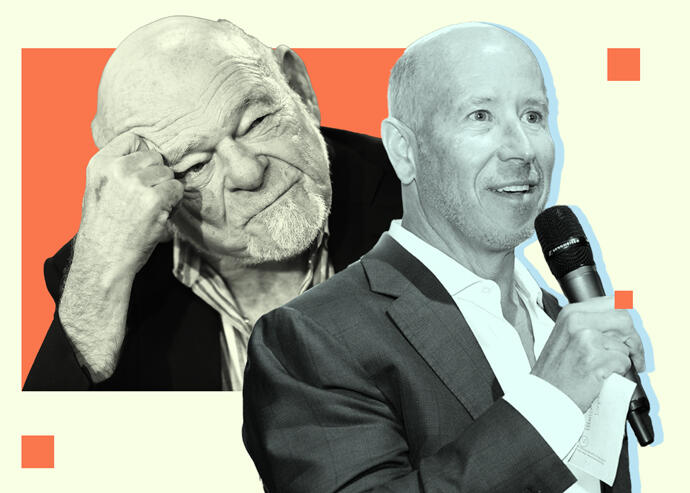

Sam Zell of Equity Commonwealth and Barry Sternlicht of Starwood Capital Group (Getty)

Two months after Monmouth Real Estate Investment reached a deal to be acquired by Sam Zell’s Equity Commonwealth, Barry Sternlicht’s Starwood Capital Group is jumping into the ring with its own rival offer.

Starwood provided an unsolicited bid to acquire Monmouth, according to Bloomberg, which cited people familiar with the matter. The real estate investment trust confirmed it received an all-cash takeover offer from a large “private investment firm” for $18.70 per share. It did not disclose the buyer’s identity.

The deal could lead to a bidding war between two industry titans to take control of the industrial real estate-focused Monmouth, which is based in Holmdel, New Jersey. Sternlicht’s Starwood, as the rival bidder, was part of a review process earlier this year that led to Monmouth’s sale to Equity Commonwealth.

Monmouth could be on the hook for a $62 million termination fee, Bloomberg reported, if it abandons the original all-stock deal, which valued it at $3.4 billion. The terms of that deal would see Monmouth’s investors receive 0.67 shares of Equity Commonwealth for each Monmouth share they own.

The real estate firm said its board is evaluating Starwood’s offer.

[Bloomberg] — Keith Larsen