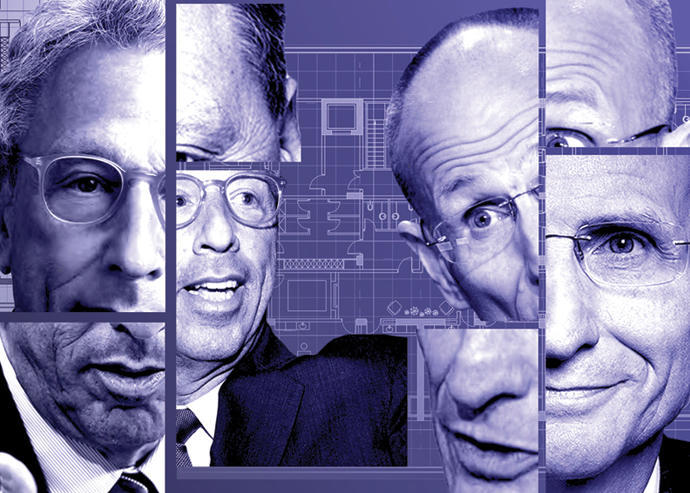

Newmark’s Barry Gosin (left) and CBRE’s Bob Sulentic

As a vision of the post-vaccine future of the workplace began to emerge late last year, Industrious co-founder Jamie Hodari was nearing a new funding round with a private equity firm in October. Then, CBRE came calling.

The entrepreneur sat down for a socially distanced dinner with CEO Bob Sulentic and Andrew Kupiec, head of CBRE’s in-house co-working platform, Hana. They left him convinced that his IPO-bound startup was better off partnering with the world’s largest commercial real estate services firm.

“After that dinner it was really clear something was going to be done,” said Hodari, who said he saw how the two firms could capitalize on each other. “It all got done pretty quickly from there.”

In February, CBRE announced it had ponied up $200 million for a 35 percent stake in Industrious, making it the largest investor in the eight-year-old startup now reportedly valued at $600 million. The news came just three weeks after one of CBRE’s arch rivals, Newmark, agreed to acquire the flex-office operator Knotel out of bankruptcy. (Newmark gave Knotel about $20 million in debtor-in-possession financing and made a $70 million stalking-horse bid to acquire the company, Delaware bankruptcy court documents show.)

In less than a month’s time, two of the largest commercial brokerages, whose bread and butter for decades had been traditional office leasing, had made heavy bets on two of the biggest flex-office operators at a critical time for both industries. With millions of people in the country receiving a vaccine daily and employers eyeing a return to normalcy, plans for the workplace are coalescing around the hybrid model, in which employees will divide their time working from home, going into the company office and working from satellite locations with more flexibility.

The new state of play is a shot in the arm for the on-demand office business, capital-intensive ventures which at one point last year did not seem likely to survive the pandemic. But it’s also putting pressure on the big commercial firms to get more serious about a sector that they had mostly dabbled in, given that the large corporate tenants that had been their mainstays for so long are scaling back their traditional office footprints.

That could make 2021 a year of unprecedented consolidation in the space, and could fundamentally change the way companies think about, locate and occupy office space.

CBRE and Newmark’s competitors won’t be able to ignore their plays. But will they mimic them, or choose another path?

“That may be one approach, to own one of the brands or have a stake in one,” said Anthony Paolone, an analyst at JPMorgan who covers some of the large brokerages. “But you could also argue, do you want to be an open architecture to use the brokerage platform to help occupants find the right space, irrespective of who’s operating it?”

Feelin’ flexy

“The future is flexible,” had been the rallying cry for the on-demand office industry long before the pandemic hit. And while that may previously have been questioned as starry-eyed, self-serving speak, perceptions have changed.

CBRE recently found that 86 percent of its occupier clients, some of the largest corporations in the world, plan to use flex office space in their real estate mix.

Major tenants such as Salesforce and HSBC have announced plans to switch to the hybrid model and reduce their office footprints, with the latter looking to trim its portfolio by 40 percent. Salesforce, headquartered out of a 1.4 million-square-foot San Francisco skyscraper, for which it has naming rights, recently backed out of a 325,000-square-foot new office lease nearby and announced it will embrace remote work.

Major tenants such as Salesforce and HSBC have announced plans to switch to the hybrid model and reduce their office footprints, with the latter looking to trim its portfolio by 40 percent. Salesforce, headquartered out of a 1.4 million-square-foot San Francisco skyscraper, for which it has naming rights, recently backed out of a 325,000-square-foot new office lease nearby and announced it will embrace remote work.

“An immersive workspace is no longer limited to a desk in our Towers; the 9-to-5 workday is dead,” Salesforce’s chief people officer Brent Hyder wrote on the company blog last month.

To keep up with where their clients are going, the big brokerages are getting more exposure to flex.

“All the major brokers are going to want to be deeply involved in flexible workspace,” said Joe Du Bey, founder of the office-management software startup Eden Workplace. “It’s going to be a big part of the future over the next 12 months as things come back.”

Some firms like Avison Young and Colliers International have launched broker teams dedicated to helping tenants find flexible-office locations. Others have launched their own in-house operators, like CBRE’s Hana, which will fold its 10 work centers into Industrious’ platform.

Though they may take different paths, many of the firms see their flex offerings as another entry in the long list of services added on in recent years, as they’ve expanded beyond their core business of brokerage into fields such as property management and workplace advisory.

If their landlord clients want to turn some of their real estate into flex space and their tenants want more on-demand options, the big full-service firms figure this is the place to be. For those that want to become operators, they have two options: Start something in-house or team up with an existing operator.

JLL is choosing the former route, getting ready to open the first location under its in-house flex firm in Brooklyn in April.

The company will open the 50,000-

square-foot Orchard workspace at Brookfield Property Partners’ MetroTech complex in Downtown Brooklyn.

“We need to evolve to service the interests of our investor clients,” said Ben Munn, who oversees JLL’s flex space division.

Cushman & Wakefield is also taking the in-house approach. The company launched its co-working brand, INDEGO, in February 2020 in the U.K. with help from Heiko Himme, WeWork’s former real estate division head for much of Europe.

Cushman, however, doesn’t appear to have any plans to import INDEGO to the U.S. Representatives for the company did not respond to requests for comment.

But those companies may be running in a race that’s already been decided.

Some see these deals as an acknowledgment that the in-house model doesn’t scale up, and the optimal route is to team up with an experienced operator.

Hana’s Kupiec said CBRE was always going to take the M&A approach, tapping the firm’s balance sheet to grow its presence.

“COVID-19 simply accelerated the need for a network of locations at scale, today, to meet the demand for workplace flexibility as employers begin to plan for a return to office this summer and fall,” he said.

Client-competitors

Not every brokerage, though, is so keen on getting into the landlord business.

Avison Young started a brokerage group focused on the flex space in the summer of 2019. But the head of that division is adamant that the firm will not be an operator.

“A lot of our competitors are either building out their own product or investing in solutions,” Charlie Morris, who heads Avison’s flex division, said. “We’re taking a more agnostic approach where we find the best product for our tenants, even if it’s owned by one of our competitors. It helps to avoid any conflict or bias.”

There’s certainly an argument to be made that these kinds of deals create a potential for conflict. Knotel founder Amol Sarva, for example, vowed not to give leasing business to CBRE when it announced in 2018 that it would launch a business competing with his.

And critics argue brokerages could be compelled to steer their tenant clients toward their own flex operators, even if a competitor’s choice is a better fit. But unless a company chooses a narrow lane — like some brokerages that exclusively represent tenants — the modern full-service CRE firms are rife with potential conflicts. And so far, it hasn’t led to their downfall.

For those looking at companies to acquire or partner up with, though, the list is growing smaller.

The two largest operators in the U.S. — IWG (which owns Regus) and WeWork — are in a league of their own with portfolios north of 20 million square feet, according to Colliers.

The next largest companies are Knotel and Industrious with roughly 3 million square feet. The two remaining operators of any notable size are the Chicago-based Novel Coworking and Convene, the Brookfield-backed meeting-space and events company that shifted to a virtual-meetings platform in the pandemic.

Convene CEO Ryan Simonetti said interest from investors is as high as it’s ever been, though he declined to comment on specific M&A talks.

“My phone’s always ringing,” he said.

Escape velocity

The flex industry has been through several lifetimes in just a decade.

There were the boom years when WeWork was leasing up everything in sight and it seemed like there was a new startup every month aimed at some niche community looking for flexible office space.

Then there was a shock of cold water when WeWork had its failed IPO attempt in 2019 and people started asking bigger questions about the viability of the flex-space model. And when the pandemic hit, it really hit.

Now, WeWork is back on track to go public — through a SPAC of course — and those flex firms that have survived the worst of the pandemic appear primed to capitalize on the recovery.

The big question now is whether they can achieve scale. Lee & Associates NYC president Jim Wacht said that brokerages looking to grow their own operating platforms need to consider all the costs that go into a full-fledged operation.

Those investments only pencil out when the business opens enough locations to spread the costs out. But if they can achieve scale, Wacht said, there’s a potential for a big payoff.

“If you have a cheap enough rent, it’s hard not to make money in this business,” he said.

Observers were quick to point out that rent is a big factor in differentiating the CBRE and Newmark deals.

Industrious was able to survive 2020 thanks in large part to its asset-light model — the firm signs management agreements with landlords to run their spaces rather than lock in their own costly long-term leases. Hodari said the deal with CBRE gave the company its highest valuation to date, and control of the firm remains in the hands of Industrious’ founders, Hodari said.

Knotel, on the other hand, went under because of a failure to control costs and its pricey long-term leases. The company, once valued at $1 billion, is being acquired out of bankruptcy by Newmark in something that resembles a hostile takeover more than it does a friendly acquisition.

If it all sounds a bit dramatic, consider that there are two books, a documentary, a feature film and a miniseries on the rise and fall of WeWork.

Hodari acknowledged that there’s a spotlight on the industry, which he said is maturing with the recent acquisitions.

“It’s a dramatic industry,” he said. “My hope is that the industry is moving into adulthood and beyond some of the dramas of its teenage years.”